We foresee NZD/USD to drift in range as NZ/US monetary policy diverges. A recovery in export prices but decrease in trade surplus would reduce the central bank’s sensitivity to the currency, support domestic incomes and help an eventual NZD recovery.

USD effects are dominating the kiwi as NZD/USD trades above where it was before the RBNZ cut rates, but Fed deferring its rate hike dues for Q2 end adding dovish tone as lingering global economic pressures.

We continue to view the risks to the NZD outlook as being to the downside, but do not see an imminent catalyst, particularly with local data still robust.

This leaves us favouring selling NZD/USD at the top of the range, but without any urgency. We do, however, expect the USD to revert from last week’s FOMC induced sell-off as the data continues to validate a gradual US rate normalisation path.

That might well set off the next raft of unease as tensions between the real economy and financial markets flare.

Since, we could foresee risk bias on both sides, as the long term downtrend has given trend reversal signal or it is just puzzling.

Well, technically although this pair has tested minor supports at 0.6626 levels and showing considerable price bounces, but bearish pressures at 0.6870 can't be disregarded for short term trend .

The RBNZ may have brought in surprising cut rates but it also hinted the easing cycle may be over and that turned what ordinarily would be a currency negative event (a 25bps cut that was only 60% priced in ahead of the meeting) into something currency-positive.

NZD/USD at 0.6763, we continue to foresee NZD/USD to drift in range 0.6870 and 0.6510 levels.

Despite RBNZ surprises cut, the strength is considerable that offers now at 0.67 and bids at 0.6826 levels.

Hedging Framework:

Spread ratio: (Long 1: Long 1)

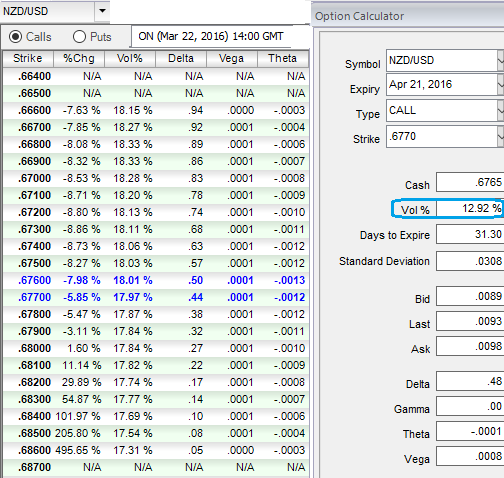

The implied volatility of 1M NZD/USD ATM call options are at 12.92%.

How to execute:

Go long in NZD/USD 1M (1.5%) in the money +0.66 delta calls, Go long 1M (1.5%) in the money -0.65 delta puts.

Huge returns for this strategy is achievable when the underlying spot FX price creates a very strong move on either direction at expiration.

The move in the underlying spot FX price must be strong enough such that either the long call or the long put rise enough in value to offset the loss incurred by the other option expiring worthless.