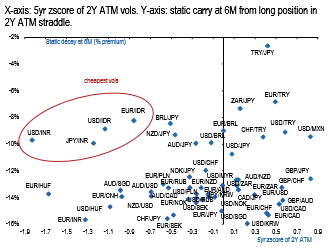

USDINR and USDIDR long-dated FX vols offer exceptionally low vol to carry.

The dramatic sell-off in 2Y USD rates since the election of Trump registers as the sharpest since the ill-fated recovery sell-off of H1 2008. While the move is showing signs of abating, especially in longer tenors, the net effect has been to push FX vs USD carry differentials to multi-year lows (above chart), especially vs G10 where only AUD and NZD remain higher yielders to USD (above chart).

Compression in rates differentials is usually consistent with softer long-dated vols and risk-reversals, as ATM vols “ride down” the vol smile, and because of the appetite for the carry trade, and thus the corresponding hedges, diminishes.

Moreover, the apparent inflection in Trump rhetoric around trade and FX wars is fuelling a broad relief6 in high beta currencies. In the case of USDIDR, anecdotal evidence suggests that dealers have been delivered long vega from structured products, and vols look particularly cheap, even when reported to the level of FX carry, a situation shared with USDCNH and USDINR (above chart).

Both USDIDR and USDINR have seen a steady portfolio and FDI inflows, and central bank interventions have replenished FX reserves even as the PBoC has struggled to curb the outflows. 2Y points are particularly appealing on the term structures of USDINR and USDIDR because ATM options incur little decay on the 18M-2Y tenor range (above chart).

Therefore one can own vega risk at a contained theta cost in USDIDR. Moreover, USDINR offers an opportunity to own USD risk-reversals at their lowest since 2007.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook