How to improve odds on AUD/JPY Put Ratio Back Spread:

Here are the ways in which one can build put ratio back spread regardless of swings. That In-The-Money puts on short side in put ratio back-spreads are always at risk of exercise, but you have two advantages.

Firstly, keeping maximum tenor on long side: Giving a longer time to expiration for long sides so as to make a substantial move on the downside so that assignment can be covered by the long puts.

Secondly, time decay advantage: Using near month contracts or contracts shorter tenor on short side signifies the importance of entering the position when IV is lower than average but AUDJPY IV is seen at 11.13% which is quite higher side (due to data season), so let us keep maturity on short side as normal as near month contract period. Time decay and implied volatility work in your favor on the short puts.

The typical position combines buying at-the-money or out-of-the-money puts and, at the same time, selling a smaller number of in-the-money puts. We recommend arresting any downside risks of this pair in medium to long term time frame. Expect the underlying currencies AUDJPY in this case to make a large move on the downside.

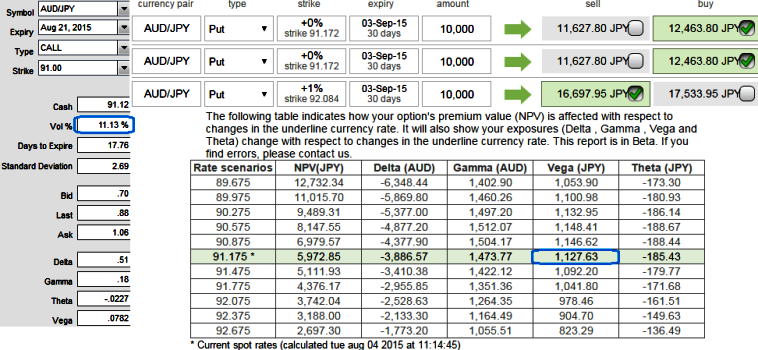

Hence, as shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 15D one lot of (1%) In-The-Money put option usually in the ratio of 2:1 (for demonstration purpose only we've used maturity as 1 month on both sides). The combined vega at 1127 indicates better chances of delta being sensitive towards IV (Ref: ATM IV of AUDJPY in nutshell).

Aussie dollar rebounding strongly today on better than expected retail sales and as the central bank kept interest rates steady as expected, citing weak commodity prices.

In Australia June retail sales spiked by 0.7%, while the trade balance for June showed a deficit of AUD 2.9 billion which is quite below 3.1 billion as forecasted. Since intraday trend being bullish bearish, buying binary calls at every dips would fetch healthy yields for the targets of 20-05 pips.

FxWirePro: Long term AUD/JPY hedging with PRBS and binary calls for swing trade

Tuesday, August 4, 2015 5:57 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate