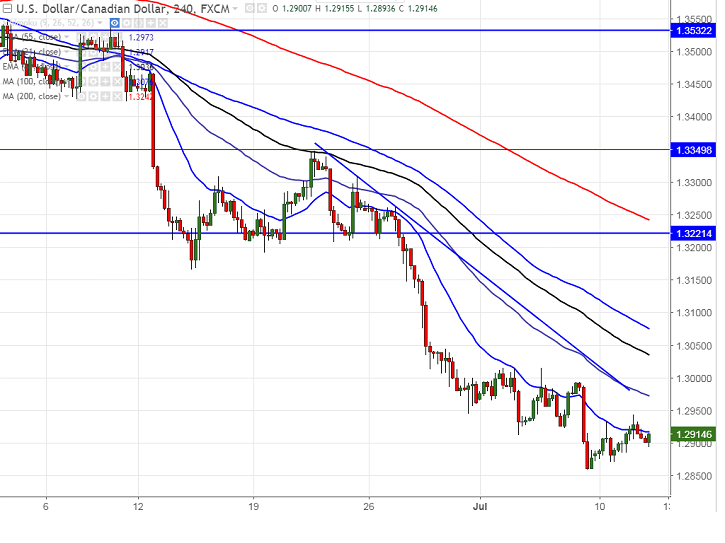

- CAD is consolidating in narrow range after hitting low of 1.28590. The pair is trading between 1.28590 and 1.29435. It is currently trading around 1.29102.

- Market awaits BOC monetary policy meeting today for further direction. BOC is expected to hike rates by 25bpbs to 0.75%. The odds of a rate hike sometime in 2017 went up from 22% to 72%.

- Crude oil prices raised sharply after Energy Information agency cuts its forecast of U.S production. U.S crude oil inventories fell by 8.1 million barrels in the week to Jul 7th to 495.6 million.

- On the higher side, major resistance is around 1.3000 and any break minor bullishness can be seen only above that level. Any break above will take the pair till 1.3045 (38.2% retracement of 1.33475 and 1.2856)/1.3100. The minor resistance is around 1.2325 (21- 4H EMA).

- The near term support stands at 1.2825 (Jun 9th 2017 low) and any break below will drag the pair till 1.27635.

It is good to sell on rallies around 1.2940-45 with SL around 1.300 for the TP of 1.2825/1.2765