We had all been pleased that with the prospect of a phase 1 agreement between the US and China uncertainty on the markets would fall and that times would become less hectic, and then the US President Donald Trump takes everyone by surprise right at the start of the New Year by creating a new flash point - this time round in the Middle East. The market reaction was pretty pronounced accordingly and the dollar appreciated due to its role as a safe haven in uncertain geopolitical times, although after the initial panic things seem to have settled down again. Since no further bad news from the Middle East followed, markets have calmed down somewhat and panic moves like in the USD or the JPY have been corrected.

It can nonetheless be assumed that the US President is unlikely to become any more conciliatory this year and instead will cause new flash points or re-open existing ones (e.g. the trade conflict with China) during the election year in an effort to attract votes.

As a result, it remains vital to keep an eye on his twitter account. However, he is unlikely to overdo it though as he will not want to significantly affect the performance of the US stock markets.

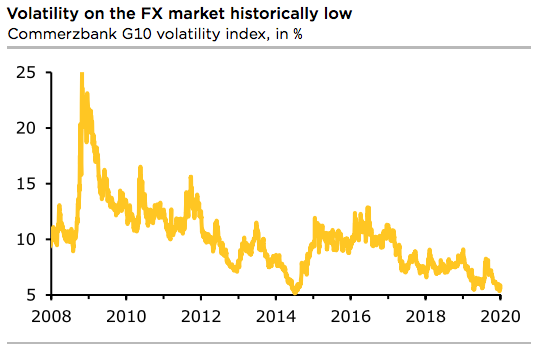

What does that mean for the FX markets? The historically low volatility is unlikely to rise notably in the near terms, but, as was the case last year, we are likely to see an intermittent rise in risk aversion which will lead to the typical reflexes amongst traders: depending on the flash point the corresponding safe havens will appreciate, with high beta and EM currencies easing. EURUSD’s low IVs also persist despite the above geopolitical tensions, the pair pops up low IVs at 4.6% for 1w tenors which is the least among G10 FX-Bloc.

Hence, contemplating above factors, initiated write an (1%) out of the money put option of 2w tenors, and add long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, (spot reference: 1.1183 level). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs. Courtesy: Commerzbank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts