This pair has been tumbling after Brexit event as the buying momentum is reduced and the long-term downtrend seems to be intact for now as the massive volumes are convincing this bearish environment on monthly charts.

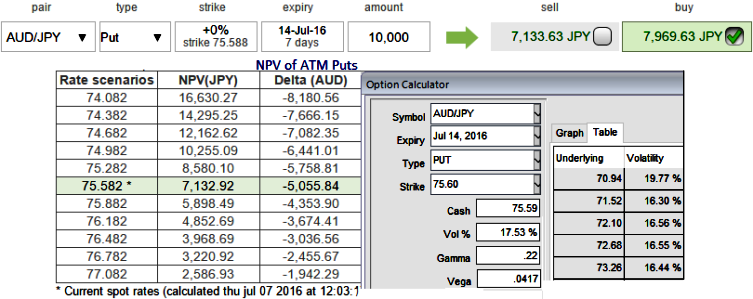

While IVs of ATM contracts of 1w and 1m tenors are trending above 17.53% as we have flurry data announcements in Japan, namely, current account balance for today.

Upper house elections are slated during this weekend. Preliminary and core machinery orders, PPI, and industrial production are scheduled for the next week.

These volatilities have been justified by historical volatilities in spot FX fluctuations.

On the flip side, ATM premiums of 1w expiries are trading at shy below 11.75% and there exists the disparity between IVs and option premiums which we perceive this as an under-priced option.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 17.44% and it is quite higher side when long-term trend is bearish and spikes in previous rallies for the short term which is a good sign for option writers. Thus, in such higher vols situation, the under-priced options are luring factor in any option strategies.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy which we’ve formulated as below.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favor but in AUDJPY case we have a very rare opportunity in under-priced puts. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure