We continue to maintain bearish stance in long run, while if any abrupt short term upswings could also to be monitored and utilized by below strategy.

We kept reiterating that this pair seems to be unlikely to sustain previous crucial supports at 80.250 levels, yesterday it has closed below these levels at 80.193.

Although it has made an attempt to bounce back to hold onto the above levels, on an intraday basis it has again broken this level.

On daily charts, the prices have slipped below 10DMA that signifies us prolong prevailing bearish sentiments after breaking supports at 81.005 levels.

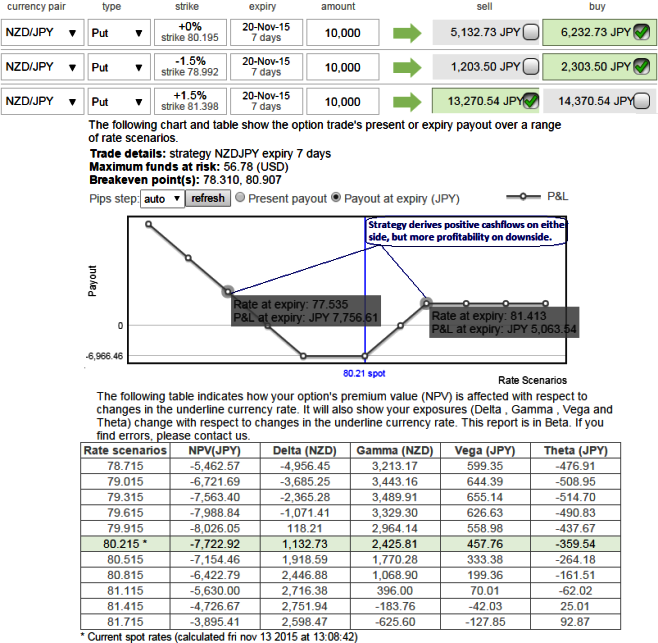

Currency Hedging Strategy: NZD/JPY Short Put Ladder

With current spot FX at 80.198 levels, the strategy takes care of long term basis hedging motives and so far our short side of 1.5% ITM put option with shorter expiry is functioning as per our predictions of upswings in near term and for now we are awaiting the functionality of longs on 15D ATM -0.50 delta put option and one more long position on 1M (-1.5%) OTM -0.39 delta put option.

Why deploying put ladders in current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to any abrupt uptrend in short term that is puzzling for now but certainly a downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term. Thereby, option writers would be on upper hand.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

FxWirePro: More dips likely for NZD/JPY – combine ATM and OTM contracts in put ladders

Friday, November 13, 2015 7:42 AM UTC

Editor's Picks

- Market Data

Most Popular