The Reserve Bank of New Zealand kept its official cash rate unchanged at record low of 1.75 percent on June 21st, 2017, as widely expected. The central bank left the monetary rate unchanged for the fourth straight meeting. Policymakers underscored that major challenges remain with persistent surplus capacity and extensive political uncertainty.

NZ swap yields in short run: NZ 2yr swap rates should open up 1bp at 2.38%, the 10yr up 2bp at 3.44%. NZ yields have risen faster than US yields during the past two weeks.

NZ swap yields in medium term perspectives: The RBNZ has signaled the next cycle – a tightening one – will not start until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which would mean occasional spikes in the 2yr will be likely. A 2yr swap range of 2.10%-2.60% is expected.

OTC outlook and options strategy:

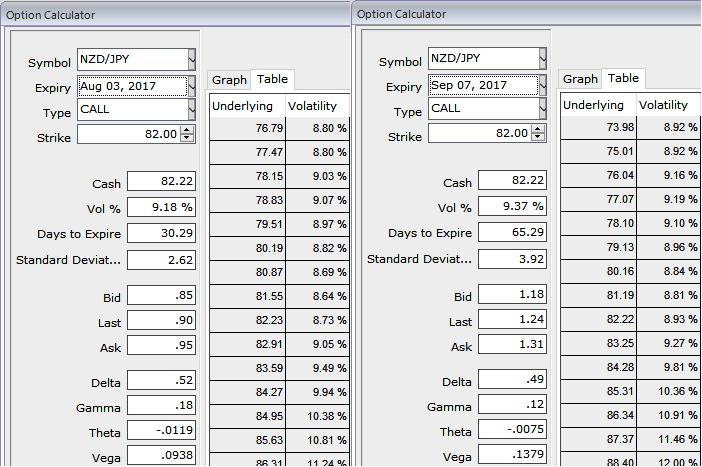

Please be noted that call options of 1m and 2m tenors are trending higher at 9.16 and 9.34% respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2w expiries.

Since the slumps are likely in near term and upswings in near term seem to be dubious as per the signals generated by technicals, for more details visit below weblink:

NZDJPY option straps strategy should take care of both upswings and downswings simultaneously, and on speculative grounds, the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on the upside.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty