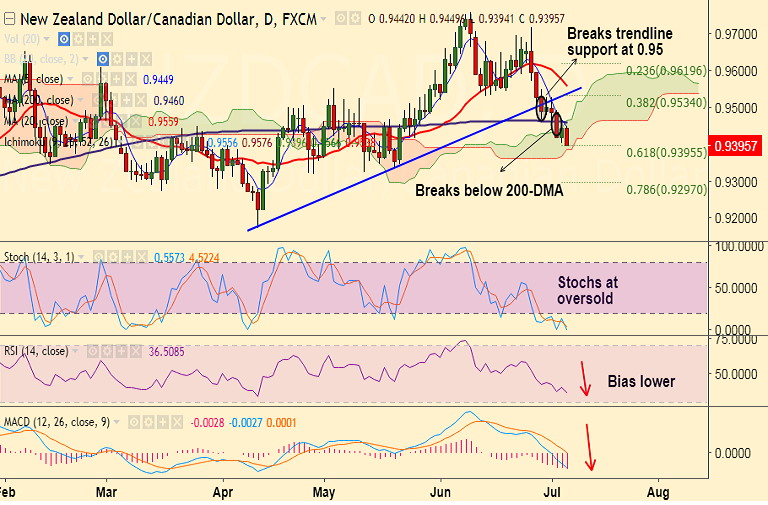

- NZD/CAD trades with a strong bearish bias, scope for test of 78.6% Fib at 0.9297.

- The pair has broken below major trendline support at 0.95 levels last week.

- Decisive break below major 200-DMA support at 0.9562 on Tuesday's trade has added to downside bias.

- Momentum studies are heavily bearish, RSI extremely weak at 36 and biased lower.

- MACD also support downtrend. However, stochs are at oversold levels, so some caution advised.

- Weekly charts are also heavily bearish, with break below weekly 20-SMA at 0.9442.

Support levels - 0.9395 (61.8% Fib retrace of 0.9171 to 0.9758 rally), 0.9386 (cloud base), 0.9297 (78.6% Fib)

Resistance levels - 0.9449 (5-DMA), 0.9460 (200-DMA), 0.95

Recommendation: Good to go short on rallies around 0.94/ 0.9410 levels, SL: 0.9460, TP: 0.9325/ 0.93/ 0.92

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -158.806 (Bearish), while Hourly CAD Spot Index was at 121.581 (Bullish) at 1015 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest