- NZD/CAD is extending previous week's massive slump where the pair fell over 3.25%.

- The major has started the week on a bearish note, trades 0.22% lower on the day at 0.8881 at the time of writing.

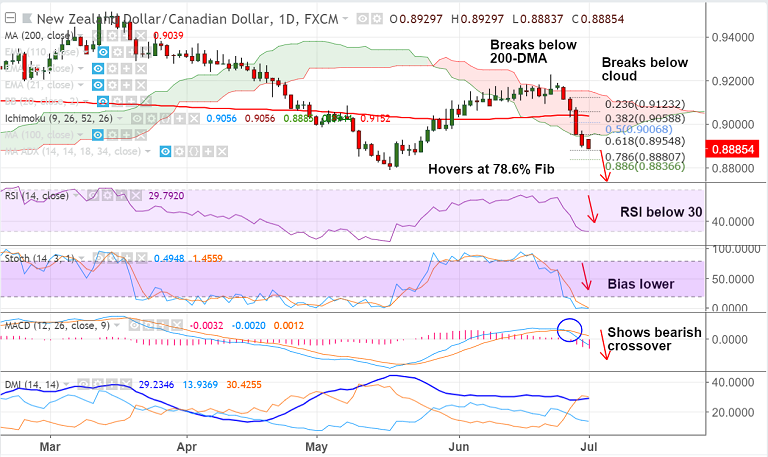

- Price action as slipped below daily cloud and is currently hovering around 78.6% Fib.

- Break below eyes next major support at 88.6% Fib at 0.8836 ahead of 0.8825 (trendline) and May 17 low at 0.8786.

- Technical analysis supports downside in the pair. Our currency strength index also shows bearishness for the pair.

- We see bearish invalidation only on retrace above 200-DMA at 0.9039.

Support levels - 0.8861 (Jan 3 low), 0.8836 (88.6% Fib), 0.8825 (trendline support)

Resistance levels - 0.89, 0.8982 (5-DMA), 0.90, 0.9039 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-CAD-consolidates-break-below-200-DMA-bias-lower-eyes-786-Fib-at-08880-1396558) has hit all targets.

Recommendation: Book partial profits at lows, trail SL to 0.8945, hold for 0.8860/ 0.8825/ 0.8790

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -89.812 (Bearish), while Hourly CAD Spot Index was at 106.473 (Bullish) at 0925 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.