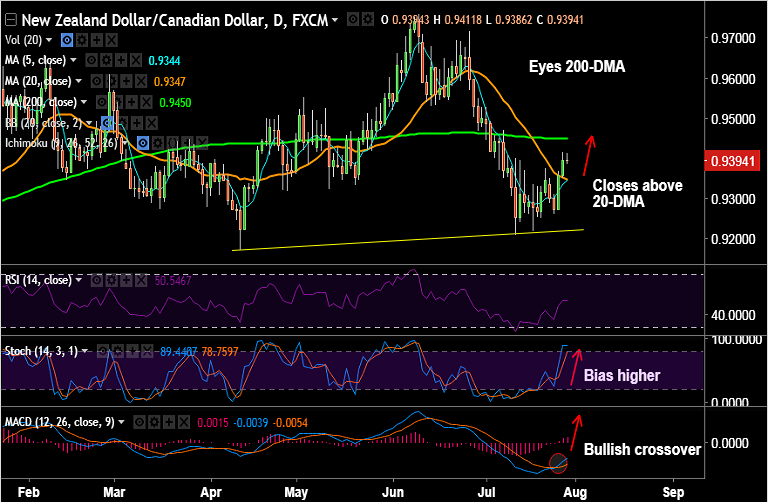

- NZD/CAD has closed above 20-DMA which has turned to be a strong support at 0.9347.

- We see the pair on track to test 200-DMA at 0.9450. Any violation there could see further upside.

- Kiwi was buoyed by strong data and Fonterra’s price revision, and upbeat Chinese industrial profits data.

- Also, the latest NZ trade balance data came in upbeat, which also added to the upside in the Kiwi.

- Technical indicators have turned slightly bullish, 5-DMA has turned, RSI and Stochs are biased higher and MACD is showing a bullish crossover on signal line.

- Kiwi bulls now await the RBNZ next month. Focus today will be on US Q2 GDP data for further impetus.

Support levels - 0.9347 (20-DMA), 0.9344 (5-DMA), 0.9220 (trendline)

Resistance levels - 0.94 (July 12 high), 0.9450 (200-DMA), 0.9465 (cloud base)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-Kiwi-buoyed-by-strong-data-and-Fonterras-price-revision-NZD-CAD-breaks-20-DMA-bias-higher-824220) is progressing.

Recommendation: Hold for targets.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest