- NZD/CAD takes a breather after massive slump in the previous session, bias remains lower.

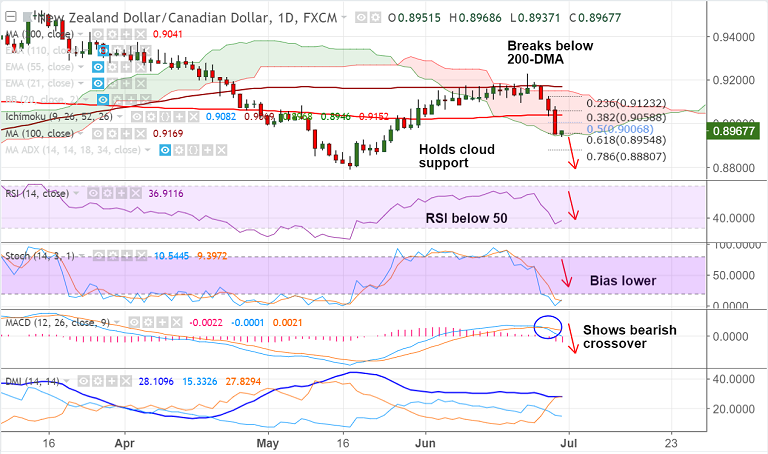

- The pair is consolidating break below 200-DMA, takes support at nearly converged cloud base and 61.8% Fib.

- Break below will see resumption of weakness. Next likely bear target lies at 78.6% Fib at 0.8880.

- Technical indicators as well fundamental factors support weakness in the pair.

- A dovish RBNZ on Thursday along will rise in crude oil prices keep downside pressure on the pair.

- We see bearish invalidation on retrace and close above 200-DMA (currently at 0.9040).

Support levels - 0.8954 (nearly converged 61.8% Fib and cloud base), 0.89, 0.8880 (78.6% Fib)

Resistance levels - 0.9006 (50% Fib), 0.9052 (5-DMA), 0.9077 (21-EMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-CAD-rejected-at-100-DMA-break-below-55-EMA-09094-opens-up-further-downside-1391587) has hit all targets.

Recommendation: Book partial profits at lows, trail SL to 0.9040, hold for further downside. TP: 0.89/ 0.8880.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -101.896 (Bearish), while Hourly CAD Spot Index was at 104.005 (Bullish) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.