- NZD/CAD retraced most of the downside on Thursday's trade to close largely unchanged at 0.9439.

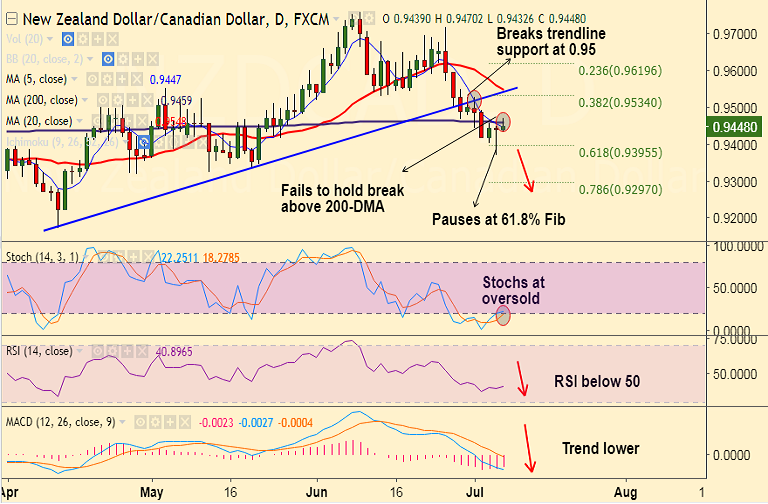

- The pair extended upside on the day to break above 200-DMA at 0.9459 and hit highs of 0.9470.

- But the pair failed to hold upside above 200-DMA and has given up most of the gains.

- Doji formation seen on daily candle, the pair trades with a strong bearish bias, scope for test of 78.6% Fib at 0.9297.

- The pair has broken below major trendline support at 0.95 levels last week and we see bearish invalidation only on close above 200-DMA at 0.9459.

Support levels - 0.9395 (61.8% Fib retrace of 0.9171 to 0.9758 rally), 0.9386 (cloud base), 0.9297 (78.6% Fib)

Resistance levels - 0.9449 (5-DMA), 0.9460 (200-DMA), 0.95

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NZD-CAD-breaks-below-200-DMA-good-to-go-short-on-rallies-790147) was stopped out.

Recommendation: We still recommend a short in the pair. Good to go short on rallies around 0.9445/55 levels, SL: 0.95, TP: 0.94/ 0.9325/ 0.93/ 0.92

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 31.1448 (Neutral), while Hourly CAD Spot Index was at -27.8666 (Neutral) at 1015 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest