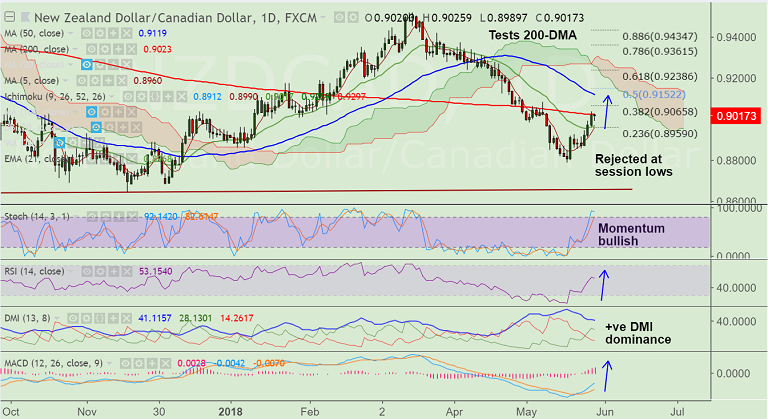

- NZD/CAD pares losses, edges higher from session lows at 0.8989. CAD dented by falling oil prices.

- 200-DMA is major resistance and we see further gains only on decisive break above.

- Technical indicators are biased higher. Momentum studies are bullish. Trend indicators support upside.

- Breakout at 200-DMA raises scope for test of 50-DMA at 0.9119. On the flipside, 21-EMA is strong support at 0.8968, weakness likely on break below.

- Markets await New Zealand (NZ) Financial Stability Report (FSR) for the next direction.

Support levels - 0.8967 (21-EMA), 0.8960 (5-DMA), 0.89, 0.8880 (Jan 5 lows)

Resistance levels - 0.9065 (38.2% Fib), 0.91, 0.9119 (50-DMA)

Recommendation: Good to go long on decisive break above 200-DMA, target 0.9065/ 0.91/ 0.9120

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 77.6819 (Neutral), while Hourly CAD Spot Index was at -36.2784 (Neutral) at 1045 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.