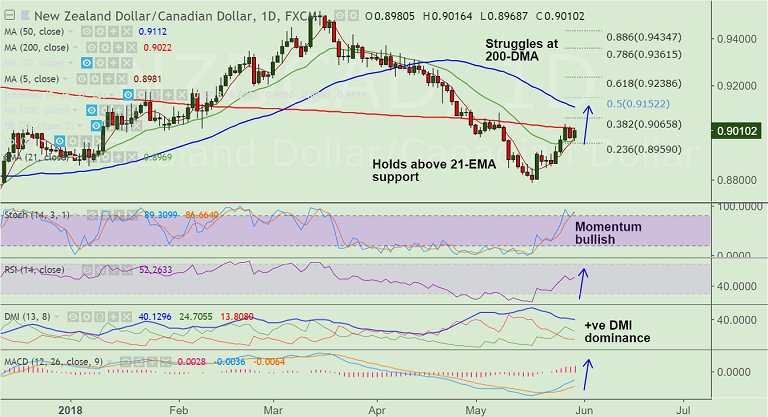

- NZD/CAD is extending choppy trade below stiff resistance at 200-DMA at 0.9022.

- Attempts to break above 200-DMA have been rejected multiple times, but momentum is with the bulls and break above could propel the pair higher.

- In its May 2018 Financial Stability Report the RBNZ noted that financial stability risks have not changed materially over the past six months.

- Technical indicators are biased higher. Momentum studies are bullish. Trend indicators support upside.

- Breakout at 200-DMA raises scope for test of 50-DMA at 0.9112 ahead of 61.8% Fib at 0.9238.

- On the flipside, the pair is holding above 21-EMA which is strong support at 0.8969. We see weakness only on break below.

Support levels - 0.8981 (5-DMA), 0.8969 (21-EMA), 0.89, 0.8880 (Jan 5 lows)

Resistance levels - 0.9022 (200-DMA), 0.9065 (38.2% Fib), 0.91, 0.9112 (50-DMA)

Recommendation: Good to go long on decisive break above 200-DMA, target 0.9065/ 0.91/ 0.9120

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.