Japan recorded a ¥242.8 billion surplus in February of 2016, compared with a ¥426 billion deficit a year earlier but missing market consensus of ¥388.6 billion surplus.

Exports were dropped by a higher-than-expected 4% on the year, due to lower shipments of manufactured goods; while imports shrank at a faster 14.2%, as purchases of mineral fuels dropped the most.

Technically, more downside traction is foreseen in the months to come as the current prices on monthly charts are well below 7&21EMAs with leading oscillators to signal selling momentum.

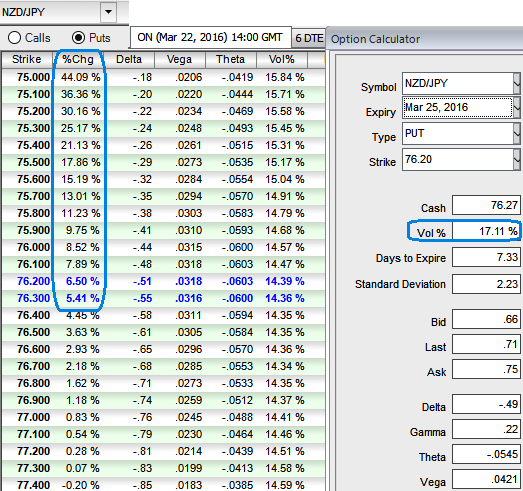

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: Unlimited downside and limited upside profit potential and higher IVs favor option holders.

1W ATM IVs are trending higher at 17.11% which means the market thinks the price has potential for large movement in either direction, but you can observe the %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts).

How to execute: Short 1W (1%) ITM put option and simultaneously add longs on 1M ATM -0.49 delta put option and one more 2M (1%) OTM -0.35 delta put option.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

What does it do with current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.