We are bearish on NZD for 2016 and forecast NZD/USD at 0.60 by Q1 16 and 0.62 by Q4 16. NZD/JPY at 75.786 by Q1 16 and 74.50 by mid-Q2 16.

Although policy de-synchronization will remain a headwind for NZD as short rate differentials compress further, the new thematic for NZD in 2016 is the prospect of a material deterioration in the current account deficit.

This dynamic will take place against a backdrop of rising US yields and thus argues for more risk premium to be priced into the New Zealand dollar.

A recovery in export prices (and the terms of trade) would reduce the central bank's sensitivity to the currency, support domestic incomes and help an eventual NZD recovery.

Some price recoveries from last couple of days would not mean that previous downtrend has ended they are to be deemed as correction rallies and could be utilized by employing short term put writings and derives certain returns.

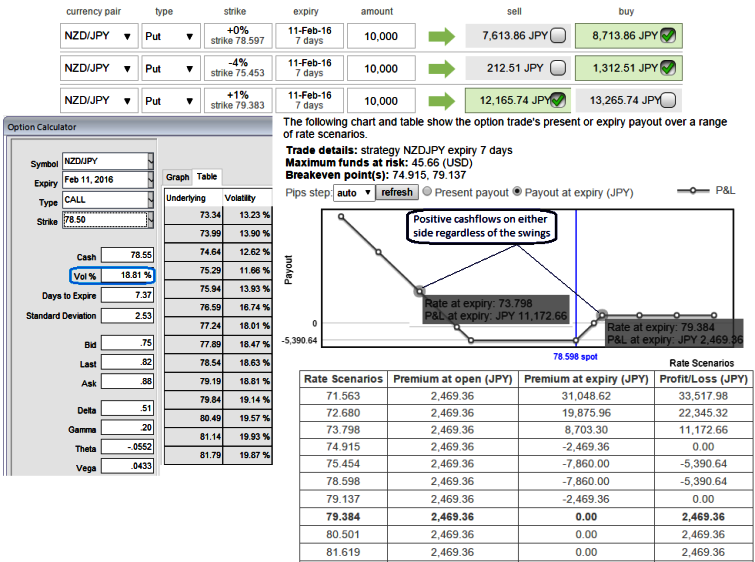

Hedging Perspectives: NZD/JPY put ladders

Here are the ways in which one can build and develop put ladders regardless of swings. That In-The-Money puts on short side in strategy were always at risk of exercise, but you have nothing worry about this now as they've expired worthless.

As shown in the diagram, the pair is likely to perceive implied volatility at 18.81% which is on higher side, holding 2 lots of put options (1 ATM and 1 OTM put) with longer expiry since implied volatility is inching higher which is good for option holders.

We've seen in the last post, using shorter tenor contracts on short side has helped us options expiring worthless and lock in profits, conversely, in the same way let us keep maturity a bit lengthier on longs.

Giving a longer time to expiration for long sides so as to make a substantial move on the downside so that assignment can be covered by the long puts like opposite to the time decay and implied volatility work in your favor on the short sides.

FxWirePro: NZD/JPY Put ladders for hedging - improve odds by keeping longer tenor on long side and time decay advantage

Thursday, February 4, 2016 6:37 AM UTC

Editor's Picks

- Market Data

Most Popular