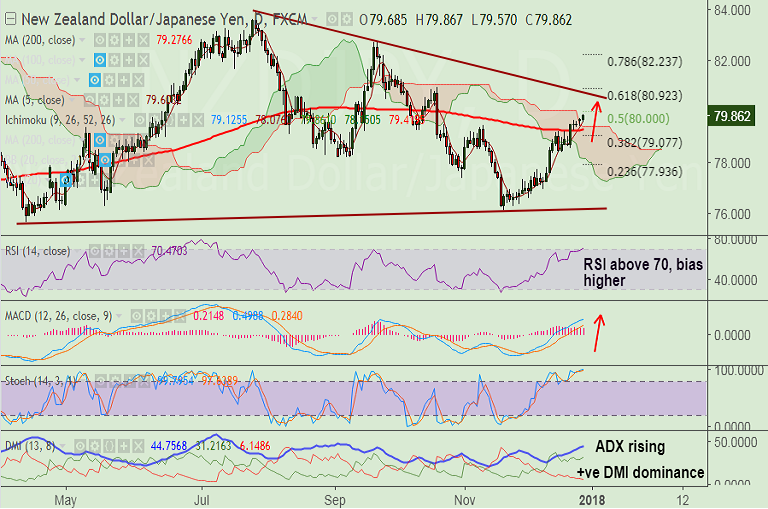

- NZD/JPY is extending breakout above 200-DMA on 20th Dec trade, bias higher.

- The pair has edged above daily Ichi cloud and we see scope for further upside.

- RSI is showing strength above 70 levels with room to run further, momentum is also highly bullish.

- ADX is above 25 levels and rising further along with +ve DMI dominance which supports current uptrend.

- The pair is trading in a falling triangle pattern and next bull target lies at 80.75 (Triangle top).

- Violation at 'Triangle top' could see further upside. While retrace below 200-DMA at 79.27 negates bullish bias.

Support levels - 79.60 (5-DMA), 79.41 (cloud top), 79.27 (200-DMA)

Resistance levels - 80.0 (50% Fib retrace of 83.910 to 76.090 fall), 80.75 (Triangle top), 80.92 (61.8% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-JPY-capped-below-200-DMA-at-7928-further-upside-only-on-break-above-1058132) is approaching TP2.

Recommendation: Book partial profits at highs, trail stop loss to 79.25, hold for upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 75.5618 (Bullish), while Hourly JPY Spot Index was at 59.994 (Neutral) at 0800 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest