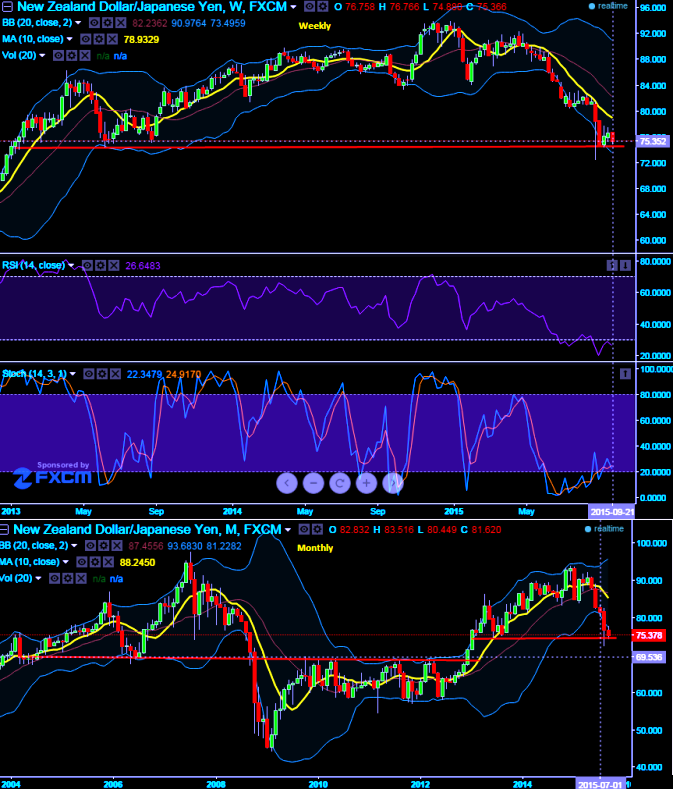

On daily charts moving averages are signifying some stress which could push the prices downwards in short term. While weekly and monthly both leading and lagging indicators to chase these slumps. We think this pair is likely to remain either on sideways or downwards for sure. Having said that the continuation of long term downtrend can also be boosted and we could foresee the strongest support at 74.59 in any near distance, if it breaks we could even see towards 69.373. So as a swing trader with a mindset of gaining these swings on both directions we constructed this strategy.

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: unlimited downside and limited upside profit potential

The pair may gain on the back of Fonterra's numbers, the NZ currency was picked up on Thursday after New Zealand milk cooperative Fonterra revised its payout forecast for the current season. Nevertheless, prices remain far below the record levels seen almost two years ago.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

How to execute: Short 7D (1.5%) ITM put option and simultaneously add longs on 15D ATM -0.50 delta put option and one more long position on 1M (-1.5%) OTM -0.39 delta put option.

What does it do with current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

FxWirePro: NZD/JPY hedgers’ eyes still on short put ladder for short term recoveries and intermediate bear trend

Thursday, September 24, 2015 7:36 AM UTC

Editor's Picks

- Market Data

Most Popular