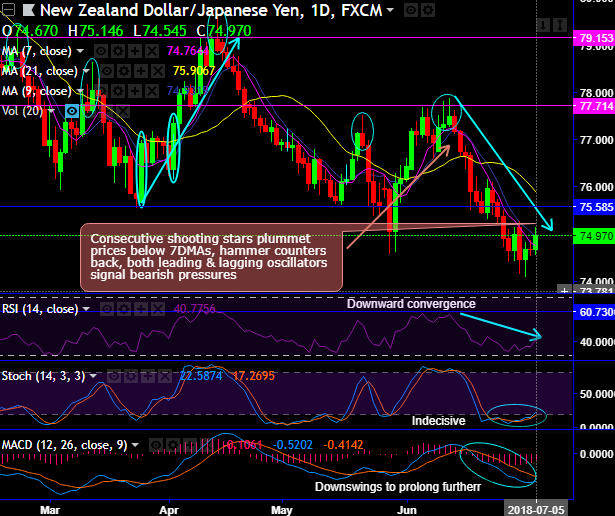

NZDJPY has constantly been tumbling ever since the formation of back-to-back shooting stars at 77.311 and 77.482 levels in the minor trend, the hammer pattern has occurred at 74.681 levels to bounce back (refer daily chart), while gravestone doji occurs at 76.752 levels on weekly terms which is bearish in nature that nudges prices below 7EMA levels. Both leading and lagging indicators have also been signalling overbought pressures (on both timeframes).

While the major downtrend likely to prolong on bearish DMA, EMA and MACD crossovers (refer daily and weekly chart).

Most noticeably, the intermediate trend slides through a descending triangle pattern which is again bearish in nature. Now, bears have managed to breach below descending triangle supports.

As a result, after brief rallies since the final week of May, the current price remains still below 7EMAs as both leading and lagging indicators bearish bias.

Both RSI and stochastic curves have been constantly showing the downward convergence that indicates the strength and momentum in the bearish interests.

Contemplating the lingering bearish sentiments on both the timeframes, at spot reference: 75.024 levels, on trading grounds we recommend buying tunnel spreads using upper strikes at 75.269 and lower strikes at 74.670 levels.

On hedging grounds, long-term investors should stay short in futures contracts of mid-month tenors.

The writers of the futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 45 levels (which is bullish), while hourly JPY spot index was at -40 (bearish) while articulating (at 11:10 GMT). For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate