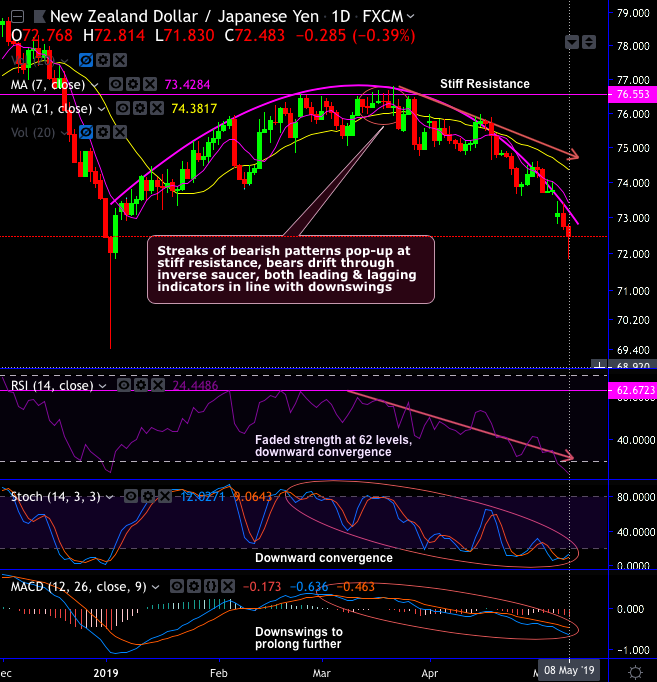

NZDJPY forms flurry of bearish patterns at the stiff resistance of 76.553 levels, consequently, bears drift through inverse saucer which is bearish in nature.

Back-to-back shooting stars and gravestone doji have occurred to signal weakness of this pair (refer circular area at the top of the inverse saucer on the daily chart). Ever since then, bears constantly plummet prices below DMAs.

While both leading and lagging indicators are in line with downswings. RSI and fast stochastic curves show downward convergence to the prevailing price dips that indicate intensified selling momentum.

On a broader perspective, to substantiate the above standpoint, the major downtrend slides through the falling wedge (refer monthly chart).

The bearish engulfing has occurred at 73.545 levels that intensifies major downtrend below EMAs, this bearish pattern nudges price below EMAs.

For now, more slumps on cards as both lagging indicators signal bearish trend continuation & RSI indicated faded strength at 56 levels and bearish bias.

Hence, we have already advocated maintaining shorts in the mid-month futures with a view of arresting the downside risks. As RBNZ has cut OCR rates by 25 bps, we could foresee more slumps on the cards. Hence, we wish to uphold the same short hedge strategy. Alternatively, one can also buy tunnel options spreads with upper strikes at 72.815 and lower strikes at 71.830 levels on intraday trading grounds.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -21 levels (which is mildly bearish), JPY at 53 (bullish), while articulating (at 05:39 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex