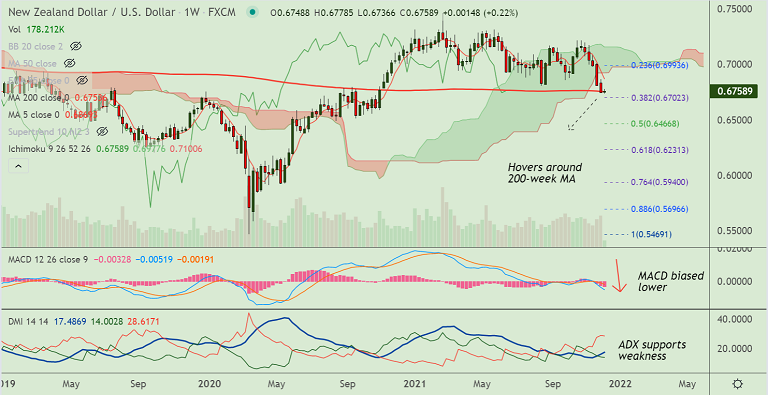

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.18% higher on the day at 0.6762 at around 09:35 GMT. The pair is extending gains after Doji formation at lows on Monday's candle. Previous week's high/low are 0.6867/ 0.6741.

Technical Analysis:

- Price action is hovering around 200-week MA, decisive break below required for further weakness

- MACD and ADX support downside, momentum is strongly bearish, Stochs and RSI show strong bearish bias

- Bollinger bands show volatility is high and rising, scope for further downside

- Price action is below cloud and Chikou span is biased lower

Major Support Levels:

S1: 0.6753 (200-week MA)

S2: 0.6702 (38.2% Fib)

S3: 0.6690 (Lower BB)

Major Resistance Levels:

R1: 0.6775 (5-DMA)

R2: 0.68

R3: 0.6808 (200H MA)

Summary: NZD/USD trades with a strong bearish bias. Watch out for decisive break below 200-week MA for downside continuation. Next major support lies at 38.2% Fib at 0.6702.