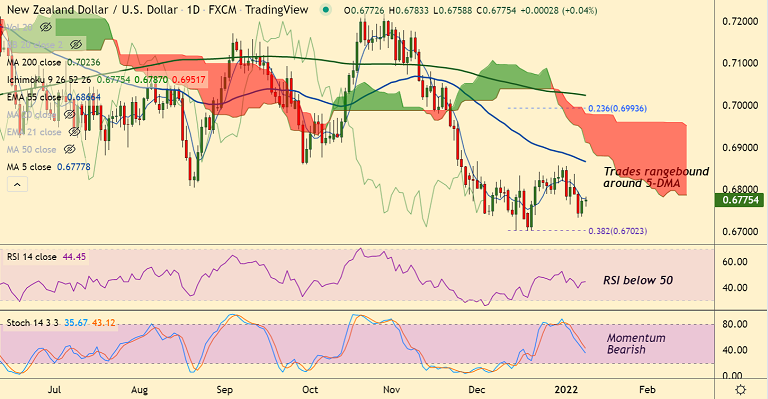

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

- NZD/USD was trading largely unchanged on the day at 0.6771 at around 09:15 GMT

- The pair remains capped below 20-DMA, decisive break above required for upside continuation

- Momentum is bearish. Stochs are sharply lower and RSI is below 50

- GMMA indicator shows major and minor trend are sharply bearish on the daily charts

Support levels - 0.6741 (200-week MA), 0.6718 (Lower BB), 0.6702 (38.2% Fib)

Resistance levels - 0.6788 (5-week MA), 0.68 (converged 200H MA and 21-EMA), 0.6874 (110-week EMA)

Summary: NZD/USD is consolidating above 200-week MA which is major support for the pair. Technical bias is neutral. Decisive break above 21-EMA could change near-term dynamics. Resumption of downside likely below 200-week MA.