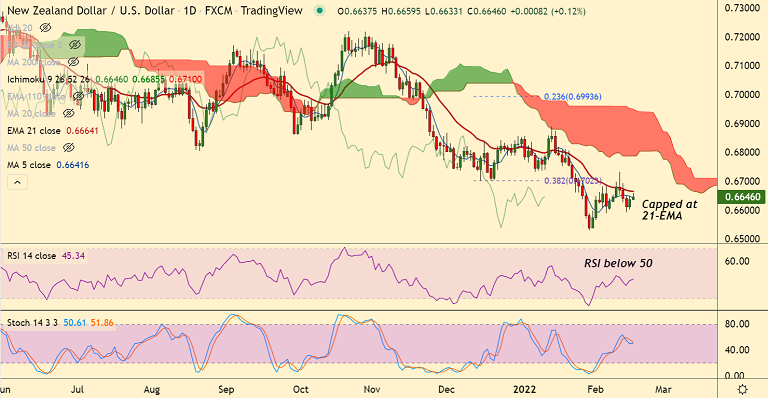

Chart - Courtesy Trading View

NZD/USD was trading 0.13% higher on the day at 0.6647 at around 11:05 GMT.

De-escalation in the Russia-Ukraine tussles after Moscow rolled back some of its troops from borders buoys antipodeans.

The Kiwi broadly ignored downbeat China inflation data which showed headline Consumer Price Index (CPI) missed 1.0% YoY forecasts with 0.9% print, versus 1.5% prior.

Further, the Producer Price Index (PPI) also declined to 9.1% YoY compared to 9.5% market consensus and 10.3% prior.

Markets eye US Fed meeting minutes and US retail sales for further direction. US January Retail Sales is expected to reverse -1.9% previous contraction with +2.0% growth.

Support levels - 0.6643 (200H MA), 0.66, 0.6548 (Lower BB)

Resistance levels - 0.6664 (21-EMA), 0.67, 0.6743 (55-EMA)

Summary: Technical bias is strongly bearish. Upside remains capped at 21-EMA, momentum is turning bearish. Price action hovers around 200H MA, close below could see more weakness.