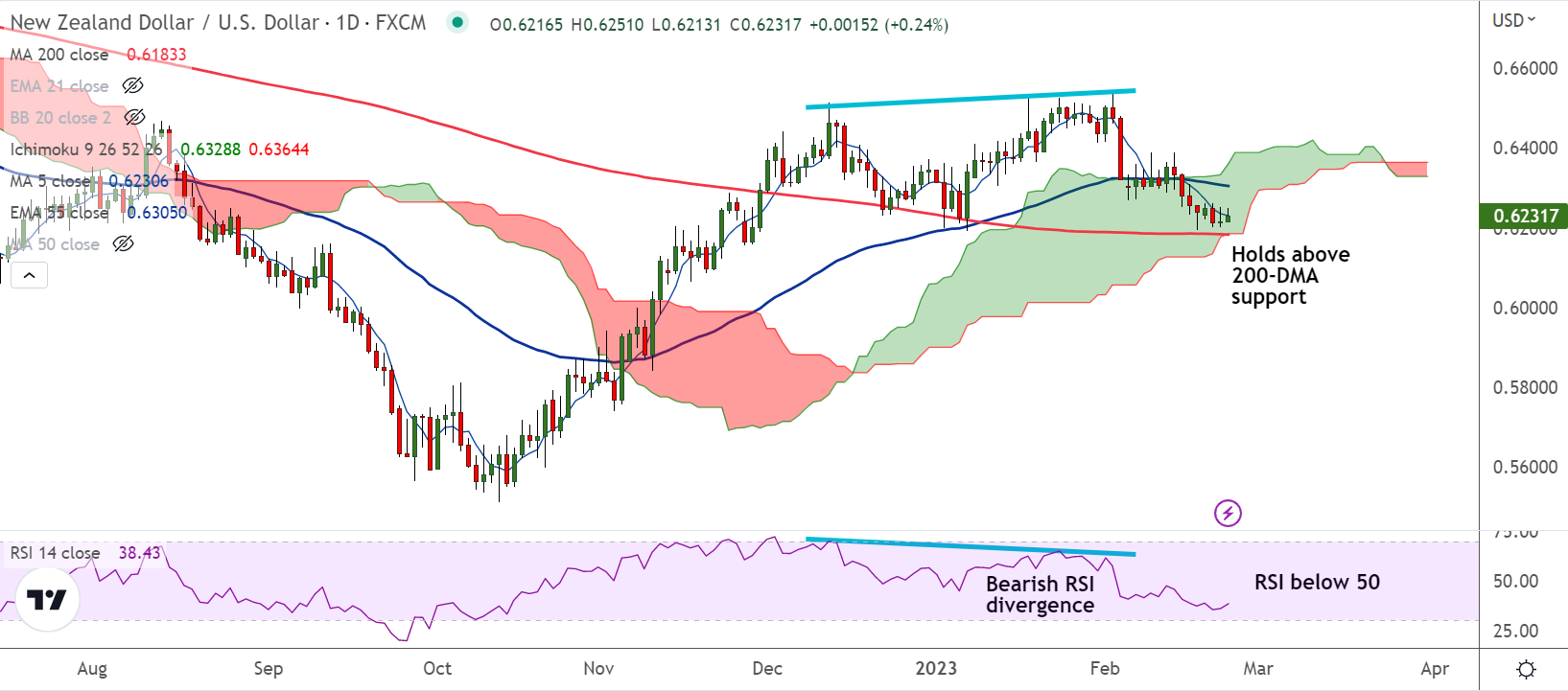

Chart - Courtesy Trading View

NZD/USD was trading 0.23% higher on the day at 0.6232 at around 09:50 GMT, hovers around 5-DMA.

Hawkish Reserve Bank of New Zealand (RBNZ), which delivered a half-point hike on Thursday, offset fears tied to the Fed rate outlook.

RBNZ Governor Adrian Orr said that core inflation is too high and that expectations are elevated, lifting bets for further policy tightening, underpinning the New Zealand Dollar.

The pair has ignored a Gravestone Doji formation on the previous session's candle and is holding marginal gains.

Momentum is bearish and volatility is high and rising. Technical indicators point to more weakness.

That said, 200-DMA is major support at 0.6183, further weakness only on break below.

Focus now on the US economic docket, featuring the release of the Prelim (second estimate) Q4 GDP print and Weekly Initial Jobless Claims data for impetus.