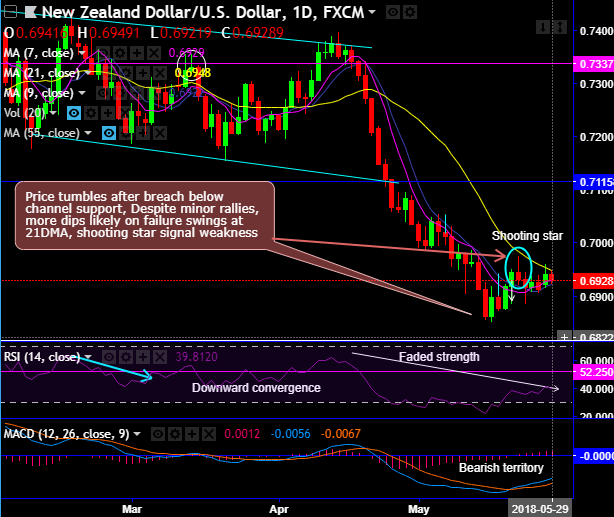

On daily plotting of NZDUSD, the price in minor trend has tumbled after breaching below channel support. For now, despite minor rallies, more dips likely on failure swings at 21DMA, while shooting star pattern candle has occurred at 0.6932 levels to signal further weakness.

Where the faded strength is observed RSI curves has dented several times in the recent past at 50-55 levels.

Subsequently, the bears have extended the minor downtrend, now selling sentiment is imminent especially after the breaching strong support below channel baseline.

While on weekly terms also, you could notice steep slumps after bearish EMA and MACD crossovers. For now, it seems that the triple top formation is extending which is again highly bearish in nature.

As the steep slumps below EMAs are observed, while both leading and lagging oscillators also substantiate bearish interests on this timeframe.

The triple top formation with top1 at 0.7485, top2 at 0.7558, 0.7437 levels and neckline at 0.6780 levels, the breach below neckline seem most likely contemplating the prevailing momentum and the trend sentiments.

Momentum study: Both leading oscillators (RSI & stochastic curves) have been showing downward convergence along with the ongoing price dips to signal bearish momentum on weekly terms, these indicators have been in bearish favor.

Trend study: While MACD’s bearish crossover coupled with EMA’s bearish crossover (7 EMA crosses below 21 EMA) that signaled downswings to prolong further.

Next strong support levels are observed at 0.6811 and 0.6780 marks (i.e. neckline of the triple top).

In our earlier posts, we’ve advised short hedges using futures contracts of mid-month tenors with a view of arresting bearish risks, these short positions seem to have been instrumental in serving the purpose.

Overall, as the US dollar finally came to life in the recent past, bears are pushing NZDUSD below its 4-month lows. If it sustains the break below 0.6950 levels (21DMA), then a further decline towards 0.6850 is on the cards.

One trading grounds, one can construct tunnel spreads using upper strikes at 0.6954 and lower strikes at 0.6804 levels.

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above 68 levels (which is bullish), and NZD at 103 (bullish) while articulating (at 07:14 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data