- Kiwi fails to sustain gains, slips lower overnight on robust U.S. data to close below 0.72 handle.

- The pair has hit 2-month lows at 0.7163 and intraday bias remains bearish.

- RBNZ Wheeler’s jawboning the NZD, downbeat NZ business confidence and the broad-based US dollar reversal weighs on the pair.

- Data released overbought showed U.S. Q2 GDP rose 3.0% annualized vs 2.7% expected, and 2.6% previous in its second estimate.

- ADP employment rose 237k in August vs 185k expected and boosted expectations of positive nonfarm payrolls report.

- New Zealand business confidence declined, coming in at 18.3 versus 19.4 last, while the ANZ Activity Outlook stood at 38.2 vs. 40.3 prior.

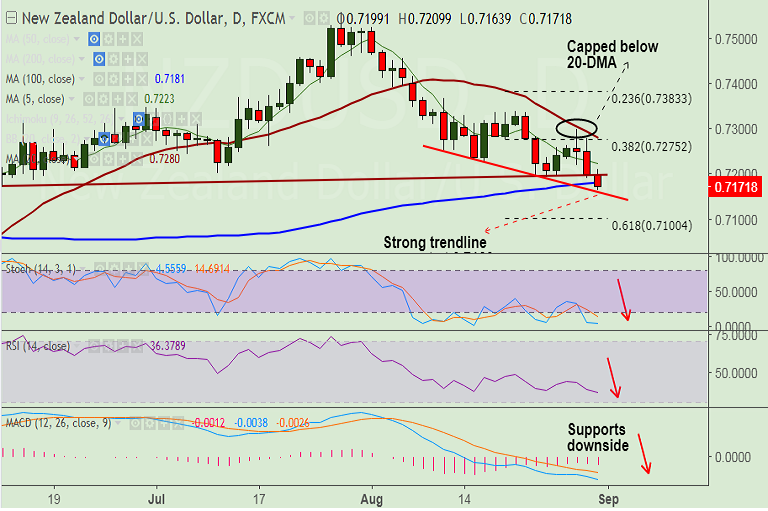

- Technically we see weakness in the pair. Weekly charts are heavily bearish. The pair has breached 100-DMA at 0.7181 on daily charts.

- We see strong trendline support at 0.7160, break below target 0.71 (61.8% Fib).

Support levels - 0.7160 (trendline), 0.7152 (weekly cloud top), 0.71 (61.8% Fib retrace of 0.68176 to 0.7558 rally), 0.7030 (cloud base)

Resistance levels - 0.7181 (100-DMA), 0.72, 0.7223 (5-DMA), 0.7280 (20-DMA)

Recommendation: Good to go short on rallies around 0.7190/0.72, SL: 0.7280, TP: 0.7150/ 0.71/ 0.7030.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -8.57158 (Neutral), while Hourly USD Spot Index was at 26.8087 (Neutral) at 0510 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest