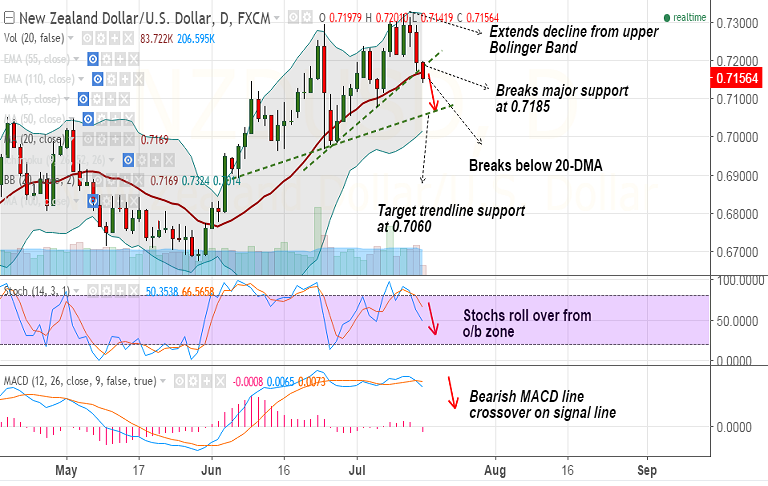

- On the daily charts the pair has broken major trendline support at 0.7185 and has fallen below 20-DMA support at 0.7169.

- Technicals are bearish, stochs have rolled over from overbought zone and we see a bearish MACD line crossover on signal line.

- Pair finds minor support at 0.7139 (July 5 low), break below will see test of 0.7060 (trendline) and then 0.7040 (double bottom (June 10 and 29).

- Immediate resistance on the upside above 20-DMA (0.7169) lies at 0.7218 (10-DMA).

- Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-breaks-major-support-at-07260-on-track-to-test-072-levels-235772) has achieved all targets.

Recommendation: Book partial profits, lower trailing stops to 0.72, target 0.71/ 0.7060/ 0.7040

Fresh shorts can be initiated on rallies around 0.7170/60, SL: 0.7230, TP: 0.71/ 0.7060/ 0.7040