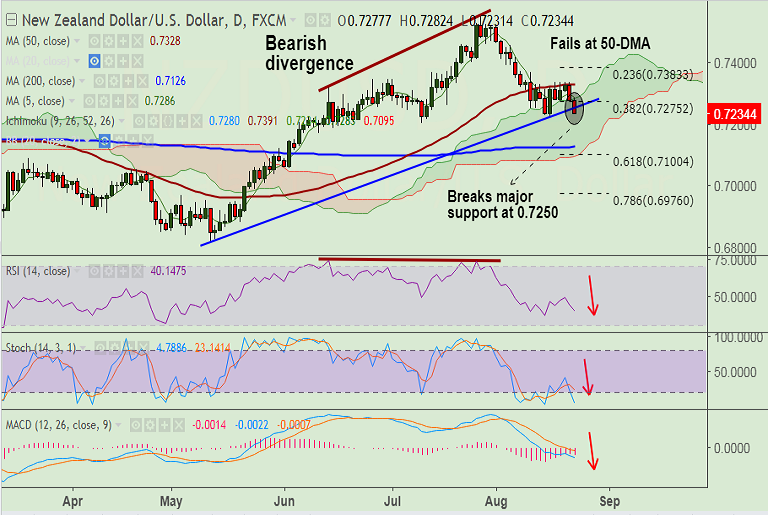

- NZD/USD broke major trendline support at 0.7250 on bearish New Zealand GDP forecasts.

- Treasury expects the RBNZ to kick-off tightening in mid-2018. The Treasury also sees a smaller surplus in 2019-21 on lower growth.

- Price action failed at 50-DMA which has been capping upside from many sessions.

- Cloud support has been breached on the downside and momentum studies are bearish.

- The pair now eyes 200-DMA at 0.7126 on break below 0.72 handle.

- We see upside only on decisive break above 50-DMA currently at 0.7328.

Support levels - 0.7201 (July 11 low), 0.7170 (June 12 low), 0.7126 (200-DMA)

Resistance levels - 0.7286 (5-DMA), 0.7328 (50-DMA), 0.7357 (20-DMA), 0.7383 (23.6% Fib of 0.6817 to 0.7558 rally)

Recommendation: Good to go short on rallies around 0.7240/50, SL: 0.7290, TP: 0.72/ 0.7170/ 0.7125

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest