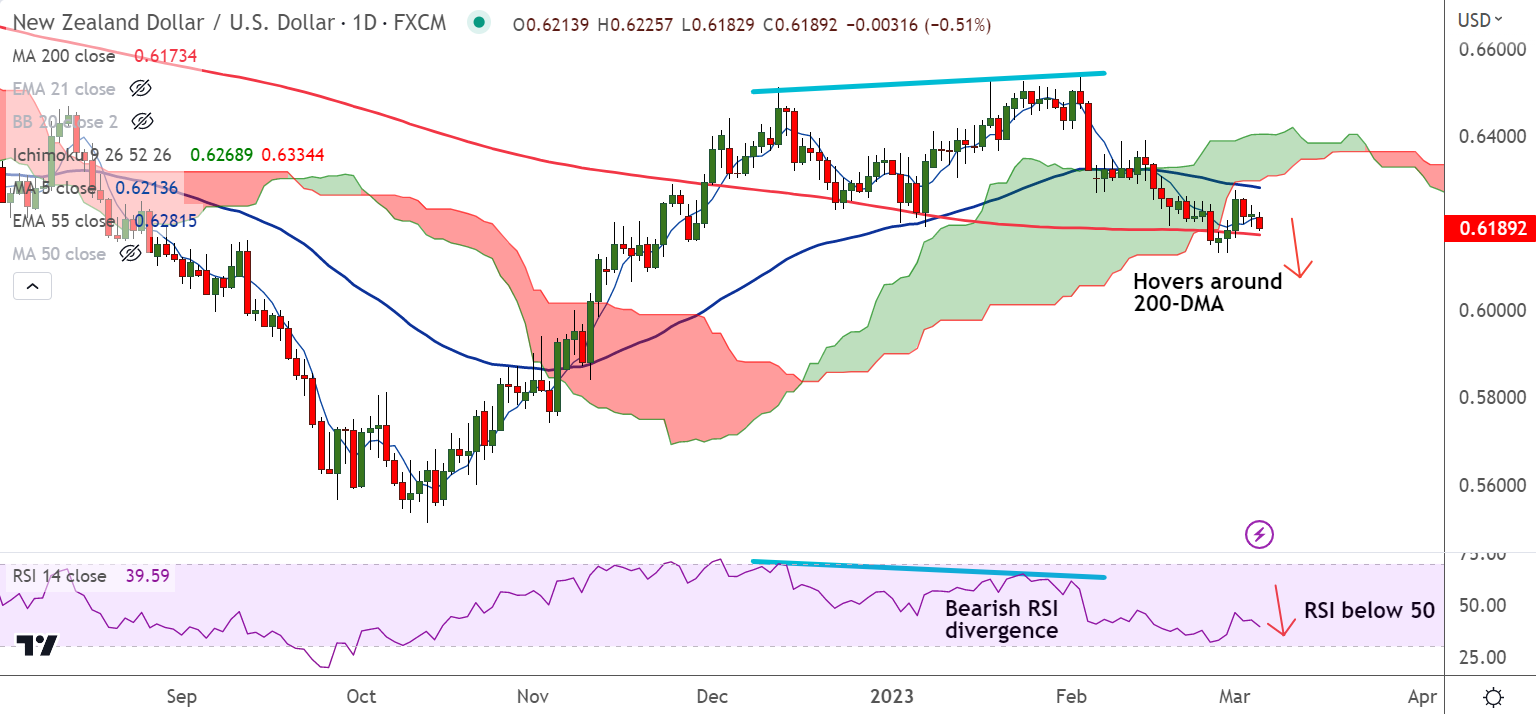

Chart - Courtesy Trading View

NZD/USD was trading 0.52% lower on the day at 0.6188 at around 10:30 GMT, edges closer towards 200-DMA support.

The New Zealand dollar drifted lower on Monday after Beijing disappointed markets by setting a modest economic growth target for this year.

Chinese authorities on Monday set a modest economic growth target for 2023 of around 5%, denting the antipodeans.

Cautious market sentiment seen ahead of Federal Reserve Chair Jerome Powell’s congressional testimony on Tuesday and Wednesday.

Powell's speech will be close watched for further guidance on the US central bank’s tightening plans.

Support levels:

S1: 0.6173 (200-DMA)

S2: 0.6137 (Lower BB)

Resistance levels:

R1: 0.6212 (5-DMA)

R2: 0.6249 (110-EMA)

Summary: NZD/USD trades with a bearish bias. MACD and ADX support downside in the pair. Bearish RSI divergence adds to the downside bias.

200-DMA is major support at 0.6173. Watch out for decisive break below for further weakness.