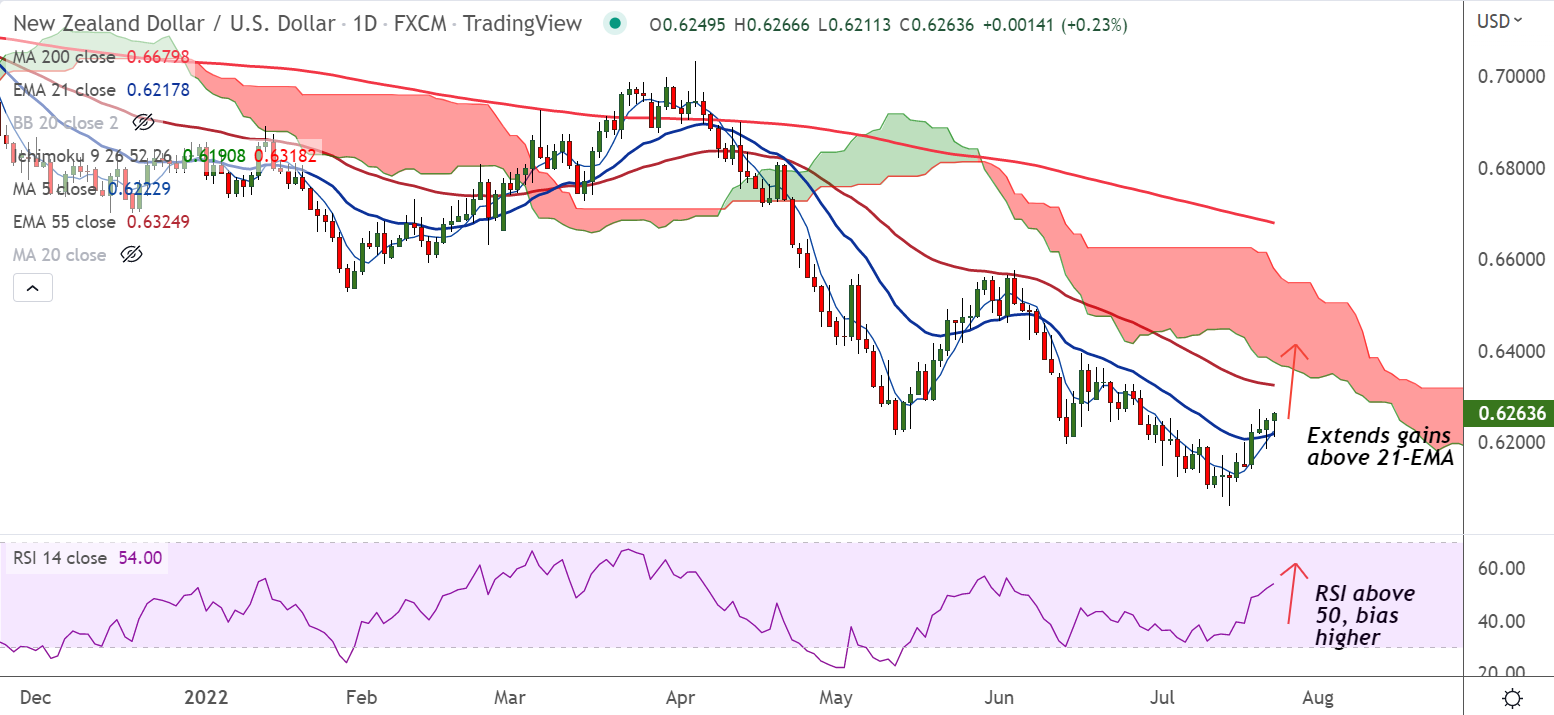

Chart - Courtesy Trading View

NZD/USD was trading 0.12% higher on the day at 0.6257 at around 11:50 GMT.

The pair is extending gains for the sixth straight session and is holding above 21-EMA support.

Momentum is with the bulls. Stochs and RSI are sharply higher and RSI is well above the 50 mark.

MACD confirms bullish crossover on signal line and Chikou span is biased higher, keeping scope for further upside.

On the data front in today’s session, focus will remain on the US S&P PMI data. The Global Composite data is seen at 51.7, lower than the prior release of 52.3.

U.S. Manufacturing PMI is likely to slip to 52 vs. 52.7 recorded earlier. While the Services PMI is expected to slip to 52.6 against the former figure of 52.7.

Support levels - 0.6217 (21-EMA), 0.6192 (20-DMA)

Resistance levels - 0.6294 (Upper BB), 0.6324 (55-EMA)

Summary: NZD/USD price action has edged higher from session lows at 0.6211 and is on track to test upper Bollinger band at 0.6294.