Chart - Courtesy Trading View

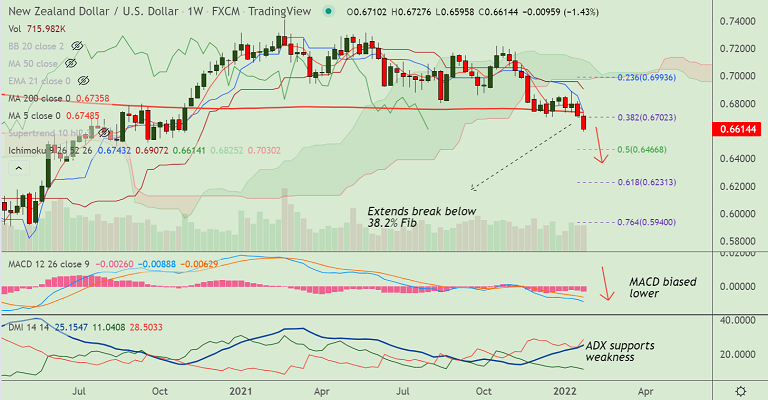

NZD/USD was trading 0.38% lower on the day at 0.6624 at around 10:30 GMT.

The pair hit fresh 14-month lows below 0.66 handle before paring some losses.

Broad-based US dollar strength after hawkish FOMC meeting outcome weighs on the antipodeans.

Further, rising investor concerns over political tensions between Russia and Ukraine exacerbates weakness.

Price action has shown a decisive break below major trendline support. The pair is extending weakness below 200-week MA.

Momentum is strongly bearish and volatility is high and rising. GMMA indicator shows major and minor trend are strongly bearish.

Scope for test of 50% Fib at 0.6466. Bearish invalidation only above 200-week MA.