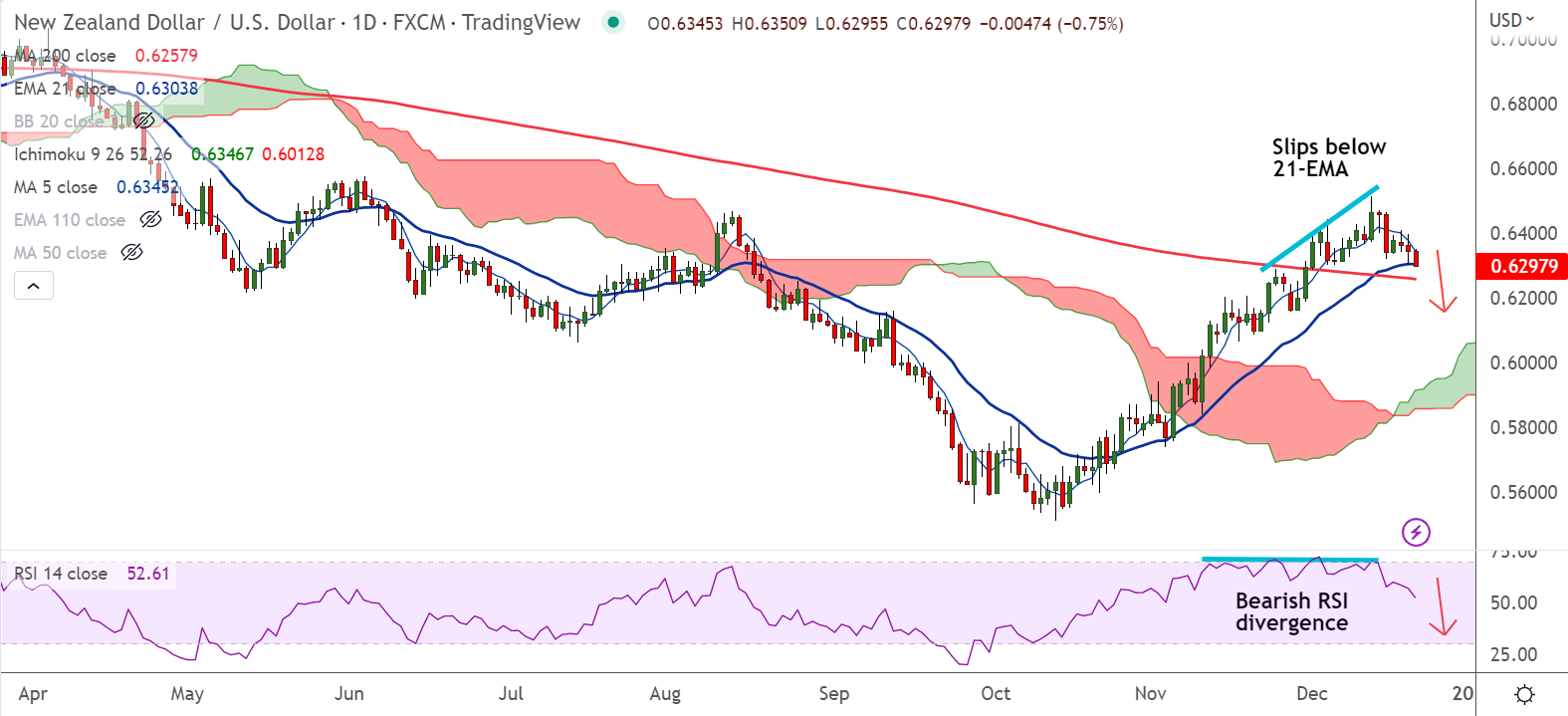

Chart - Courtesy Trading View

NZD/USD was trading 0.73% lower on the day at 0.6299 at around 06:20 GMT.

The pair is extending downside for the 3rd consecutive session, slips below 21-EMA.

Data released on Tuesday showed US Housing Starts declined by 0.5% MoM in November following October's 2.1% contraction.

Further, US Building Permits fell by 11.2% versus a 3.3% drop recorded in the previous month.

Focus now on US Conference Board (CB) Consumer Confidence data for December, expected at 101.00 versus 100.00 prior.

Price action has slipped below 21-EMA. Momentum is bearish, volatility is high and rising.

Stochs and RSI are sharply lower, Chikou span is biased lower. Bearish RSI divergence adds to the downside bias.

Support levels - 0.6257 (200-DMA), 0.6186 (Lower BB)

Resistance levels - 0.6337 (20-DMA), 0.6388 (200H MA)

Summary: NZD/USD trades with a bearish bias. The pair is on track to test 200-DMA at 0.6257. Break below to drag the pair lower.