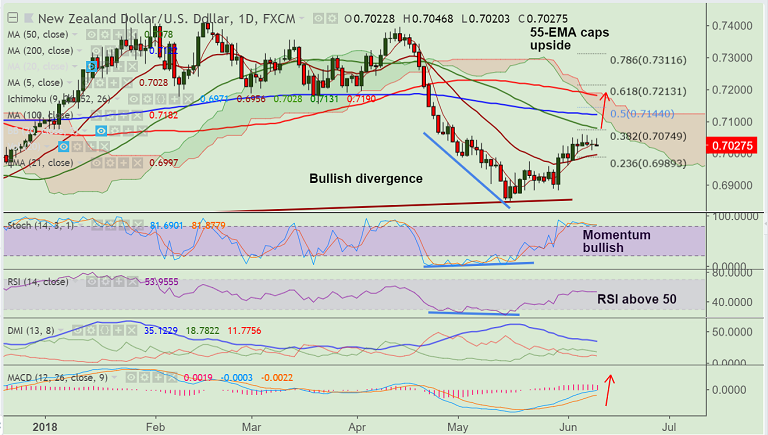

- NZD/USD is extending sideways grind, bullish divergence on RSI and stochs keeps scope for upside.

- The major has held above 0.70 handle and we see weakness only on break below.

- Upside finds immediate resistance at 55-EMA (0.7060), break above likely to test 50-DMA at 0.7078.

- Kiwi bulls hold above 200-month moving average at 0.6994, scope for further upside till 200-DMA.

- Momentum studies are bullish and a bullish divergence on RSI and Stochs adds to further upside bias.

- Worries about global trade weigh on the greenback as US President Trump withdrew his signature from the summit's G7 communique that called for fair and balanced trade.

- Break above 50-DMA to see further upside. While on the flipside, we see weakness on break below 21-EMA.

- FOMC (Wed) is highly likely to raise rates. The post-meeting statement’s and forward guidance language will be in focus.

Support levels - 0.6997 (21-EMA), 0.6989 (23.6% Fib), 0.6882 (May 30 low)

Resistance levels - 0.7028 (5-DMA), 0.7060 (55-EMA), 0.7075 (38.2% Fib), 0.7078 (50-DMA), 0.71

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-USD-Trade-Idea-1334592) has hit TP1.

Recommendation: Bias higher. Hold for further upside.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.