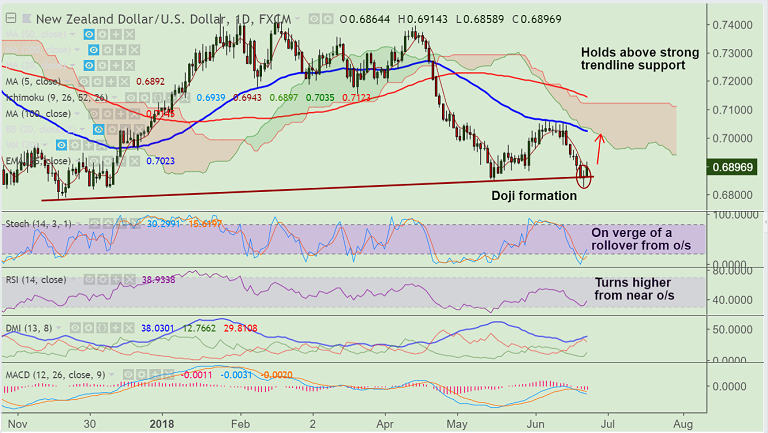

- NZD/USD fails to close below major trendline support at 0.6860, bounces of with a Doji formation.

- Weak NZ Q1 GDP data casts doubt over the expectations of a rebound in the second-quarter growth.

- Data also weighs on the Reserve Bank of New Zealand’s (RBNZ) interest rates outlook in the coming months.

- Divergent monetary policy outlooks between the Fed and RBNZ to keep sentiment undermined around the Kiwi.

- Price has broken above 5-DMA to hit session highs above 0.69 handle. Close above 5-DMA will likely see test of 21-EMA at 0.6954.

- We see major resistance at 55-EMA at 0.7023. Bearish invalidation only on break above.

- On the flipside, decisive break below major trendline support at 0.6860 to see extension of downside.

Support levels - 0.6860 (trendline), 0.6826 (June 21 low), 0.68

Resistance levels - 0.6954 (21-EMA), 0.70, 0.7023 (55-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -23.1296 (Neutral), while Hourly USD Spot Index was at -55.0908 (Neutral) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.