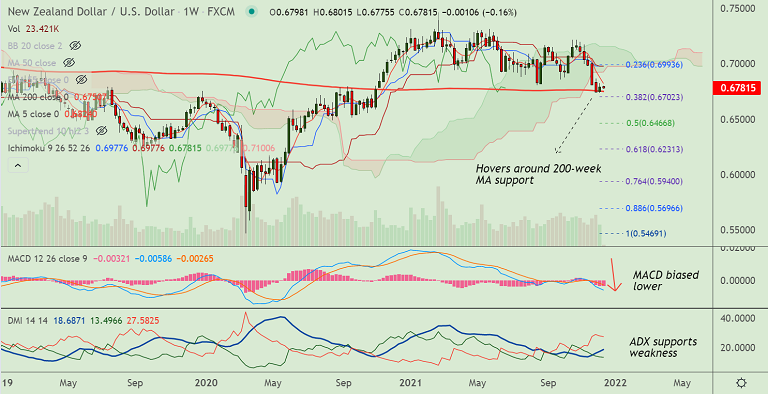

Chart - Courtesy Trading View

NZD/USD was trading 0.19% lower on the day at 0.6779 at around 07:40 GMT.

The pair has resumed downside after brief pause on Friday's trade, outlook is bearish.

Price action hovers around 200-week MA which is major support at 0.6750. Break below will plummet prices.

GMMA indicator shows major and minor trend are strongly bearish on the daily charts.

Recovery attempts in the pair have been capped at 200H MA, price action has failed to hold above 5-DMA.

MACD and ADX support downside on the weekly charts. While on the daily charts, MACD is showing some signs of bullishness on the daily charts.

Major Support Levels:

S1: 0.6750 (200-week MA)

S2: 0.6702 (38.2% Fib)

S3: 0.6678 (Lower BB)

Major Resistance Levels:

R1: 0.6823 (5-week MA)

R2: 0.6861 (21-EMA)

R3: 0.6911 (23.6% Fib)

Summary: NZD/USD trades with a bearish bias. Scope for test of 200-week MA at 0.6750. Watch out for break below for more weakness.