- Kiwi strengthens in early Asia on the back of higher than expected employment data, but failed to hold gains.

- New Zealand Q4 unemployment rate decreases to 4.5 % (forecast 4.6 %) vs previous 4.6%.

- NZD/USD trades 0.46% lower on the day, edges lower from session highs at 0.7345.

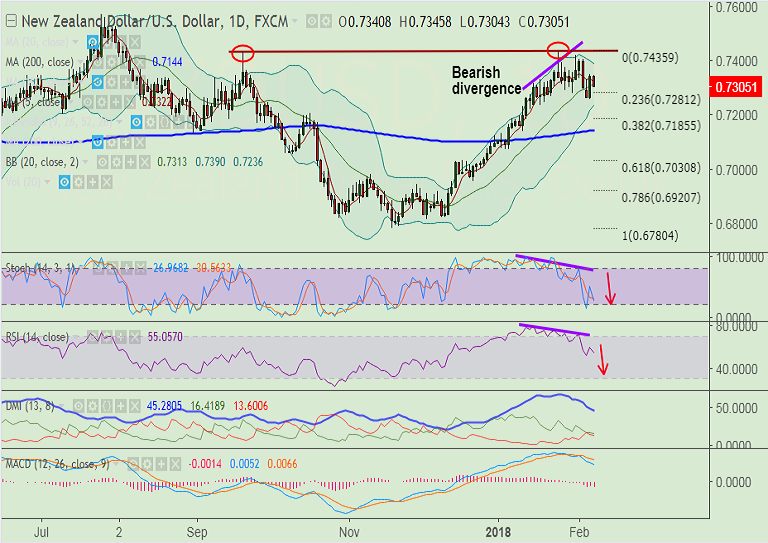

- Downside in holding above 0.73 handle and we see strong support at 20-DMA at 0.7313.

- Only decisive break below could see extension of weakness. Scope then for test of 38.2% Fib at 0.7185.

- Technical studies are bearish. RSI and Stochs are biased lower and MACD has shown a bearish crossover.

- Further we see bearish divergence from price action on RSI and Stochs which adds to the bearish bias.

- Violation at 38.2% Fib will see test of 200-DMA (currently at 0.7144). On the flipside bearish invalidation seen on break above double top at 0.7435.

Support levels - 0.7281 (23.6% Fib retrace of 0.6780 to 0.7435 rally), 0.7185 (38.2% Fib), 0.7144 (200-DMA)

Resistance levels - 0.7322 (5-DMA), 0.74, 0.7435 (double top)

Recommendation: Good to go short on decisive break below 20-DMA, SL: 0.74, TP: 0.7280/ 0.7185/ 0.7145.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest