- NZD/USD stalls upside after poor China PMI and NZ business confidence earlier today.

- The pair erased most gains and trades largely muted at 0.7506, intraday bias neutral.

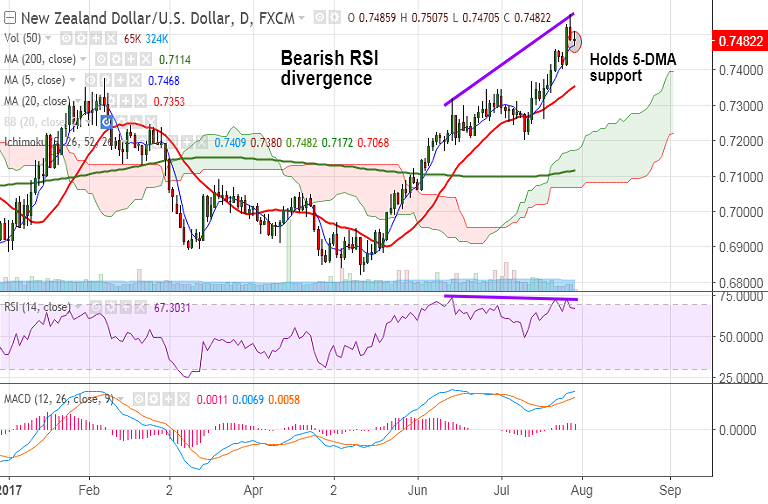

- Bearish RSI divergence on daily charts raises scope for some downside.

- Bias remains higher as long as the pair holds 5-DMA support. Break below could see minor weakness.

- We see any reversal in trend only on decisive break below weekly 200-SMA support at 0.7424.

Support levels - 0.7488 (5-DMA), 0.7424 (weekly 200-SMA), 0.7365 (20-DMA)

Resistance levels - 0.7558 (July 27 high), 0.7613 (Feb 2015 high), 0.7697 (Mar 2015 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-breaks-triple-top-good-to-long-break-above-major-resistance-at-07431-814851) has hit TP1&2.

Recommendation: Watch out for break below 5-DMA for minor weakness.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 69.9514 (Neutral), while Hourly USD Spot Index was at -53.1785 (Neutral) at 0610 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest