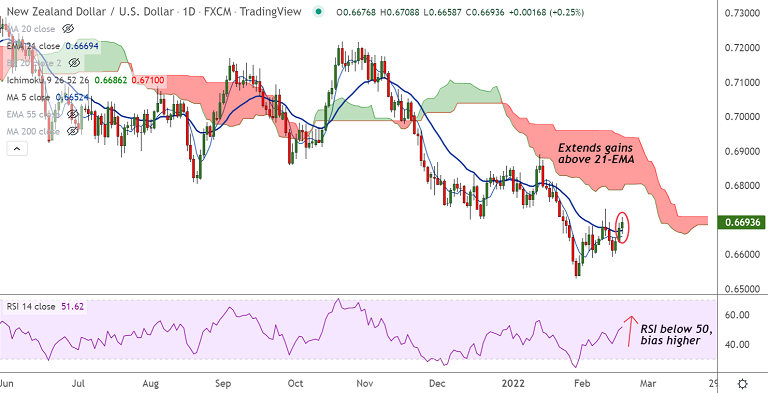

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.32% higher at 0.6698 at around 09:30 GMT

Previous Week's High/ Low: 0.6732/ 0.6601

Previous Session's High/ Low: 0.6691/ 0.6633

Fundamental Overview:

Sudden risk-off seen in the markets after reports of Ukrainian firing of mortar shells and grenades at four localities in the self-proclaimed Luhansk People's Republic.

Antipodeans to benefit from China's softer inflation and upbeat Foreign Direct Investment (FDI) figures for January.

Further, minutes from the Federal Reserve's January meeting released overnight were less hawkish than expected causing the dollar and bets on aggressive hikes to ease slightly.

Focus now on U.S. housing market numbers, jobless claims and Philadelphia Fed Manufacturing Survey, along with Fedspeak and updates from G20 for impetus.

Technical Analysis:

- NZD/USD is attempting to extend gains above 21-EMA

- GMMA indicator shows major trend in the pair is bearish, but minor trend is turning bullish

- Momentum is with the bulls, Stochs and RSI are biased higher

- Price action is above 200H MA

Major Support and Resistance Levels:

Support - 0.6649 (200H MA), Resistance - 0.6742 (55-EMA)

Summary: NZD/USD poised to extend gains above 21-EMA, eyes 55-EMA at 0.6742.