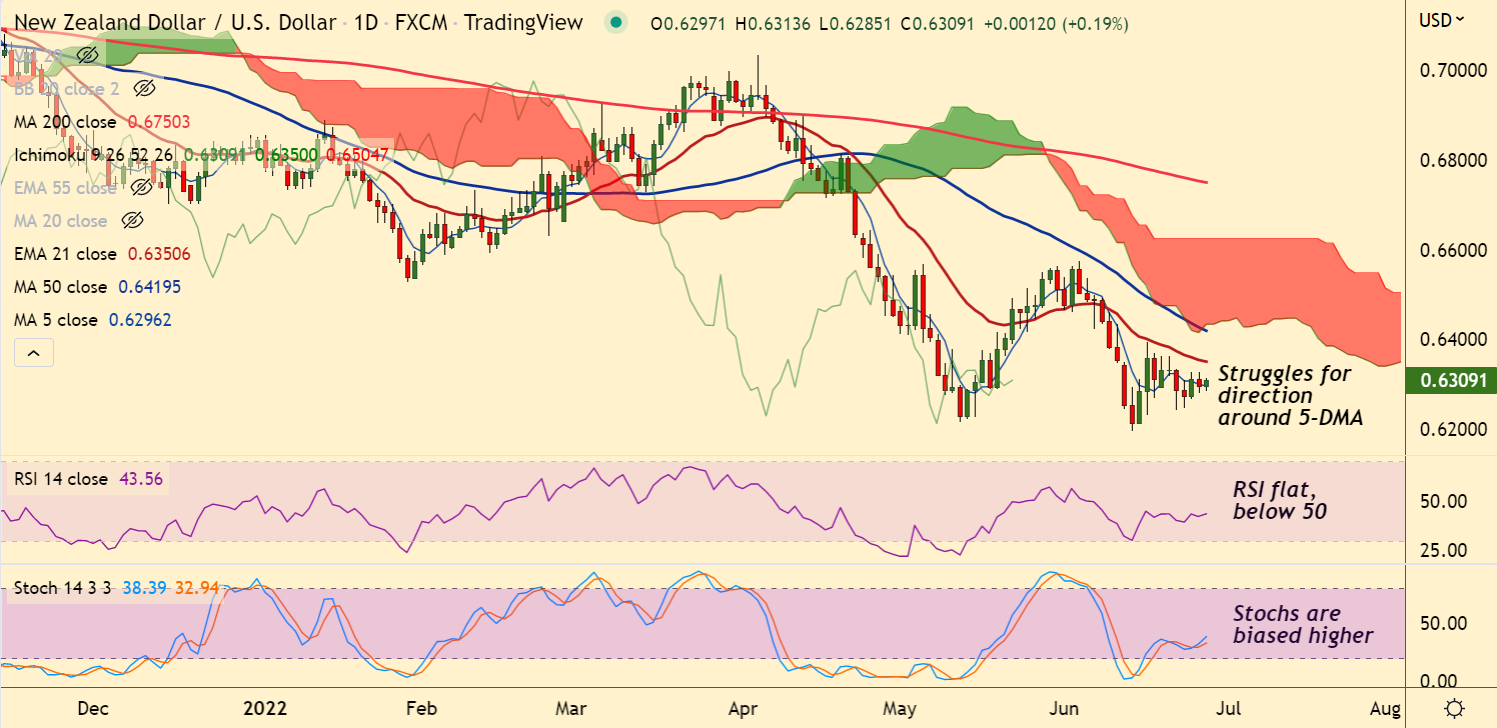

Chart - Courtesy Trading View

NZD/USD was trading 0.13% higher on the day at 0.6306 at around 06:45 GMT.

The pair is holding marginal gains on the day as markets await US Home Sales and Consumer Confidence data for direction.

Fed rate hike bets have likely cooled off amid growing worries of a sharp economic slowdown.

That said, a stronger than expected US Durable Goods and Pending Home Sales data portray a healthy economy, which could withstand big rate hike.

NZD/USD trades with a major bearish bias, but struggles for direction around 5-DMA.

Price action hovers around 200H MA and decisive break above will fuel further gains.

Major Support Levels:

S1: 0.63

S2: 0.6243 (June 22 low)

Major Resistance Levels:

R1: 0.6350 (21-EMA)

R2: 0.6363 (20-DMA)

Summary: NZD/USD struggles for direction, major trend remains bearish.