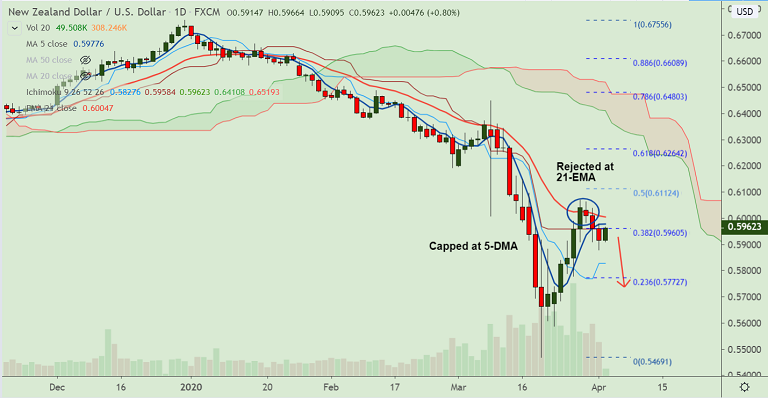

NZD/USD chart - Trading View

NZD/USD was trading marginally higher in the Asian session, recovery lacks traction.

The pair has paused three straight sessions of downside, but bias remains bearish.

The sentiment remains risk-averse as evidenced by risk-off action in the stock markets.

Technical analysis supports weakness. Major trend is bearish and minor trend is neutral. Upside remains capped at 5-DMA.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) keeps check on upside in the pair.

Fears of a prolonged recession likely to cap gains seen in NZD. Focus on US Jobless Claims for further impetus.

Analysts expect the US initial jobless claims for the week ended March 27 to exceed 4.45 million versus preceding week's figure of 3.283 million.

Support levels - 0.5888 (200H MA), 0.5827 (Tenkan sen), 0.5772 (23.6% Fib)

Resistance levels - 0.5978 (5-DMA), 0.6005 (21-EMA), 0.6112 (50% Fib)

Guidance: Good to stay short on break below 200H MA (0.5888), SL: 0.6000, TP: 0.5830/ 0.5775/ 0.57

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025