• NZD/USD traded in narrow range on Monday as traders’ attention shifted to this week’s release of key U.S. inflation data

• Investor focus is on U.S. consumer prices, scheduled for Tuesday, which will offer cues on the Federal Reserve's path for rate cuts.

• A hotter-than-expected reading could trigger volatility by dampening expectations for near-term interest rate reductions.

• An upside surprise in inflation data would challenge market wagers on a September rate cut, with markets currently pricing in about a 90% probability of easing that month and at least one more cut by year-end.

• Meanwhile, U.S. President Donald Trump’s August 12 deadline for a U.S.-China deal loomed over markets, with chip policy remaining at the heart of the standoff, and expectations building for another extension.

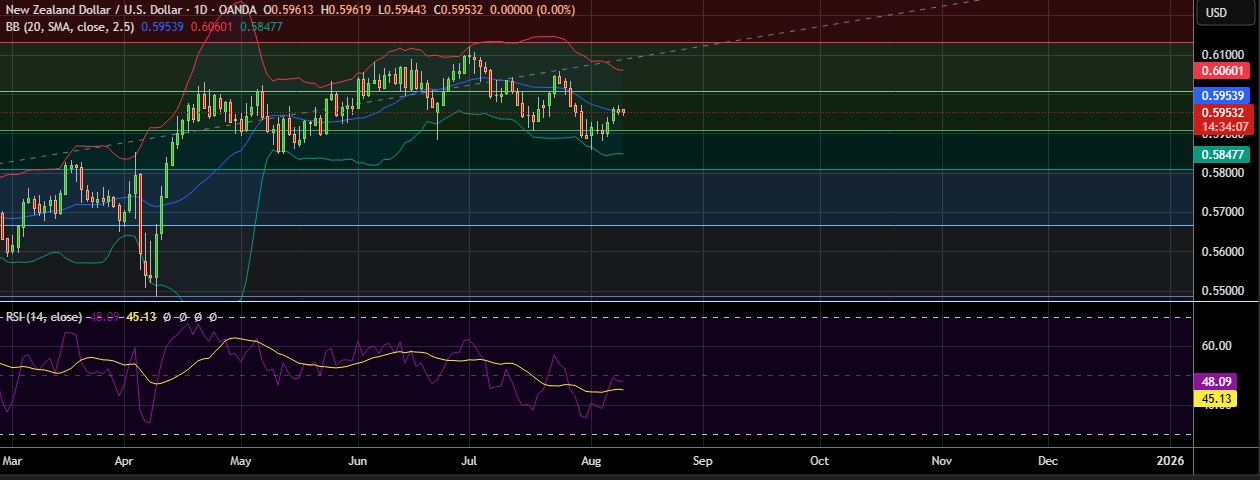

• Immediate resistance is located at 0.5998(38.2%fib), any close above will push the pair towards 0.6038 (Higher BB).

• Support is seen at 0.5954 (SMA 20)and break below could take the pair towards 0.5901(50%fib).

Recommendation: Good to sell around 0.5960 with stop loss of 0.6000 and target price of 0.5860