- Kiwi remains strongly bid as the bulls found renewed impetus from upbeat Chinese factories data.

- Caixin PMI data showed a solid improvement in the Chinese factories, Dec PMI jumps to 4-year high.

- China’s December Caixin Manufacturing PMI came at 51.9 vs 50.9 last, much stronger than expectations of a 50.9 reading.

- NZD/USD up 0.75% on the day, trading at 0.6973 at 0510 GMT. Intraday bias higher.

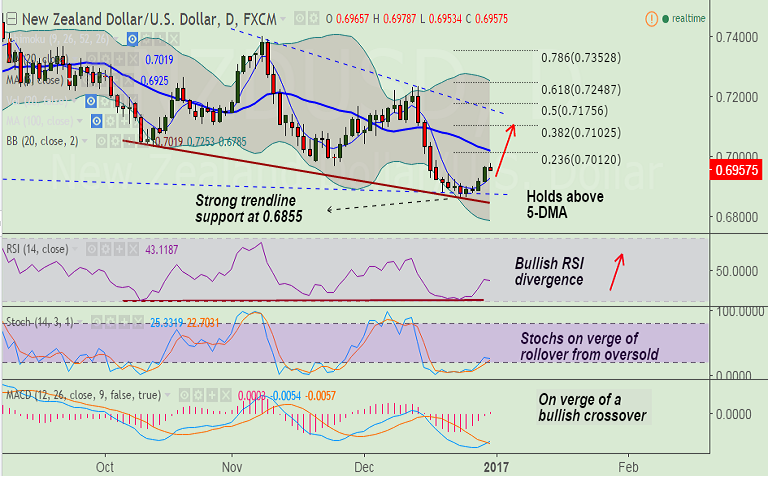

- Technical studies are bullish, we see scope for test of 20-DMA at 0.70.

- Breach of 20-DMA resistance could find next resistance by 23.6% Fib at 0.7012.

- NZ GDT price index and a set of manufacturing PMI reports from the US due on the cards in the NA session.

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-extends-recovery-from-multi-month-lows-break-of-5-DMA-seen-good-to-buy-dips-466713) is progressing well.

Recommendation: Book partial profit at highs. Hold for upside.

Support levels:

S1 - 0.6940 (5-DMA)

S2 - 0.6862 ( Dec 23 low)

S3 - 0.6875 ( trendline support)

Resistance levels:

R1 - 0.70 (20-DMA)

R2 - 0.7012 (23.6% Fib of 0.7485 to 0.6865 fall)

R3 - 0.7086 (50-DMA)