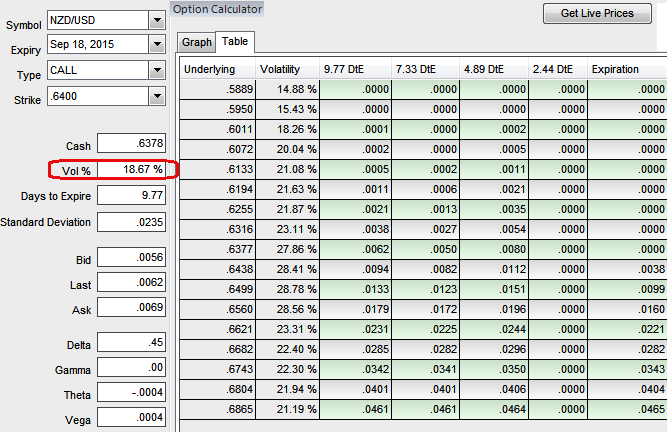

The implied volatility for next month ATM contracts of NZDUSD pair is seen at 18.67%, which is comparatively higher in APAC currency baskets.

Contemplating intraday bull sentiments, we recommend on pure speculation basis buying one touch binary calls in order to extract maximum leverage for extended profitability. By employing At-The-Money binary delta calls one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch NZD/USD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

As we had earlier advocated calendar spreads on hedging grounds, currently short calls on job in NZD/USD calendar spreads, far month contract holds stronger.

Our shorts on 15D 1% OTM calls are performing well enough so far as the NZDUSD is dropping its prices, chances of continue to drag for further slumps then this portfolio can be rest assured as the short call would take care of this. Thereafter, the jobs of 60D long call would begin. As the volatility near month ATM contracts of NZD/USD ATM contracts is to perceive at 14.79% which is still quite on higher sides, deploying customized calendar combination using ATM call options have been more suitable considering above technical reasoning.

Kiwi dollar after a long lasted losing streak that was started from last 1 year or so to hit almost 6 year's lows has now changed its direction. Buy 60D (far month) At-The-Money 0.51 delta call and simultaneously short 15D near month contract (1%) Out-Of-The-Money call (strike at 1165) with positive theta value.

FxWirePro: NZD/USD one touch spreads to speculate HY vols but calendar spreads for hedging

Wednesday, September 9, 2015 6:28 AM UTC

Editor's Picks

- Market Data

Most Popular