Chart - Courtesy Trading View

NZD/USD was trading 0.21% higher on the day at 0.6226 at around 06:00 GMT, down from session highs at 0.6245.

The Reserve Bank of New Zealand (RBNZ) hiked interest rates as expected on Wednesday and forecast more increases will follow.

The RBNZ hiked its Official Cash Rate by 50 basis points to 4.75%, its highest level since 2008, following a record-high 75 bps hike in November.

The central bank warned that inflation still remained too high in the near-term and the OCR still needs to increase in order to bring inflation within the RBNZ’s target range.

RBNZ noted that annual headline inflation is expected to be 7.3% in the March 2023 quarter and is only expected to reach the RBNZ’s 2% target by late-2025.

The bank added that New Zealand’s gross domestic product is expected to decline by 1.1% over 2023, especially as interest rates rise and the labor market cools.

The New Zealand dollar reacted positively to the rate hike, hit session highs at 0.6245, but pulled back after Governor Orr's comments.

Cautious mood ahead of the Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes also probes bulls in the pair.

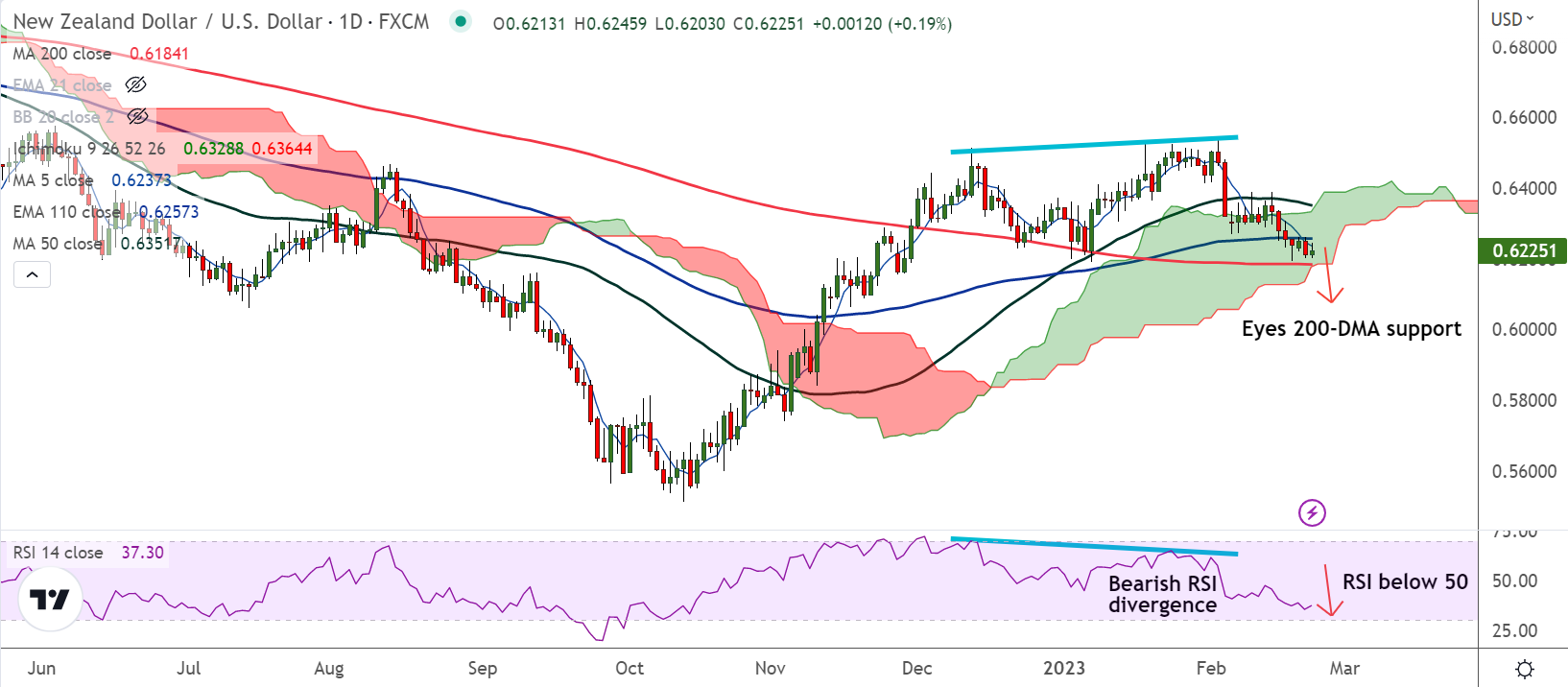

Major Support Levels:

S1: 0.6184 (200-DMA)

S2: 0.6157 (Lower BB)

Major Resistance Levels:

R1: 0.6257 (110-EMA)

R2: 0.6280 (200H MA)

Summary: NZD/USD near-term bias remains bearish. 200-DMA is major support at 0.6184. Decisive break below will plummet prices.