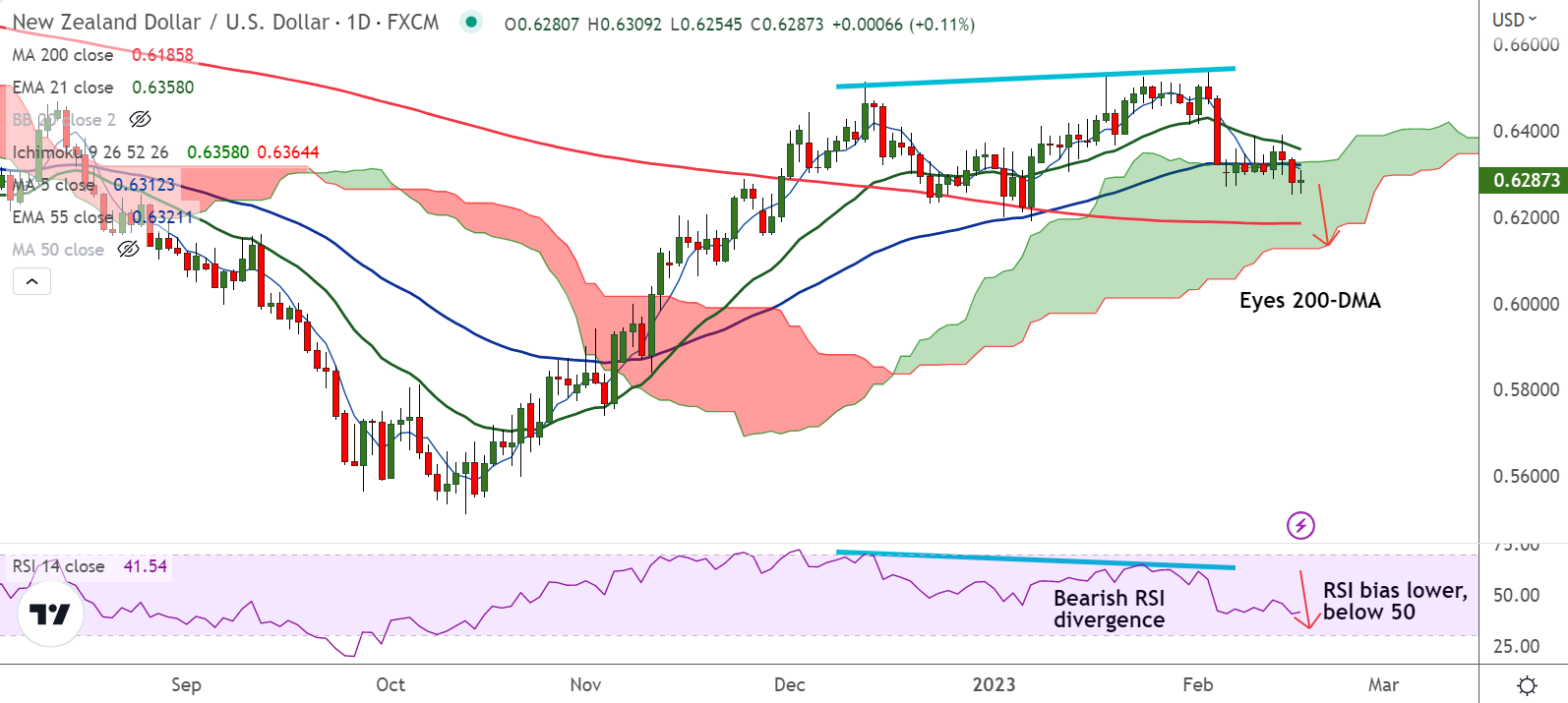

Chart - Courtesy Trading View

NZD/USD was trading 0.07% higher on the day at 0.6285 at around 11:20 GMT, forms Doji on the daily candle at the time of writing.

Data released on Wednesday showed US Retail Sales growth jumped to 3.0% YoY in January versus 1.8% expected and -1.1% prior. Core Retail Sales grew by 2.3%, beating estimates of +0.8%.

Further, NY Empire State Manufacturing Index for February improved to a three-month high of -5.8 versus -18.0 expected and -32.9 market forecasts. While, US Industrial Production came in at 0.0% MoM for January, missing estimates of 0.5% and -0.7% prior.

The pair is holding support at 110-EMA, but technical indicators support weakness in the pair.

Price action has broken consolidation around cloud top and 55-EMA and has slipped lower into the Ichimoku cloud.

Momentum is bearish and a bearish RSI divergence on the daily charts raises scope for further downside.

Price action is below cloud and GMMA indicator shows bearish trend on the intraday charts.

Support levels - 0.6259 (110-EMA), 0.6185 (200-DMA)

Resistance levels - 0.6320 (55-EMA), 0.6357 (21-EMA)

Summary: NZD/USD trades with a bearish bias. Watch out for break below 110-EMA for further weakness. Scope for test of 200-DMA at 0.6185.