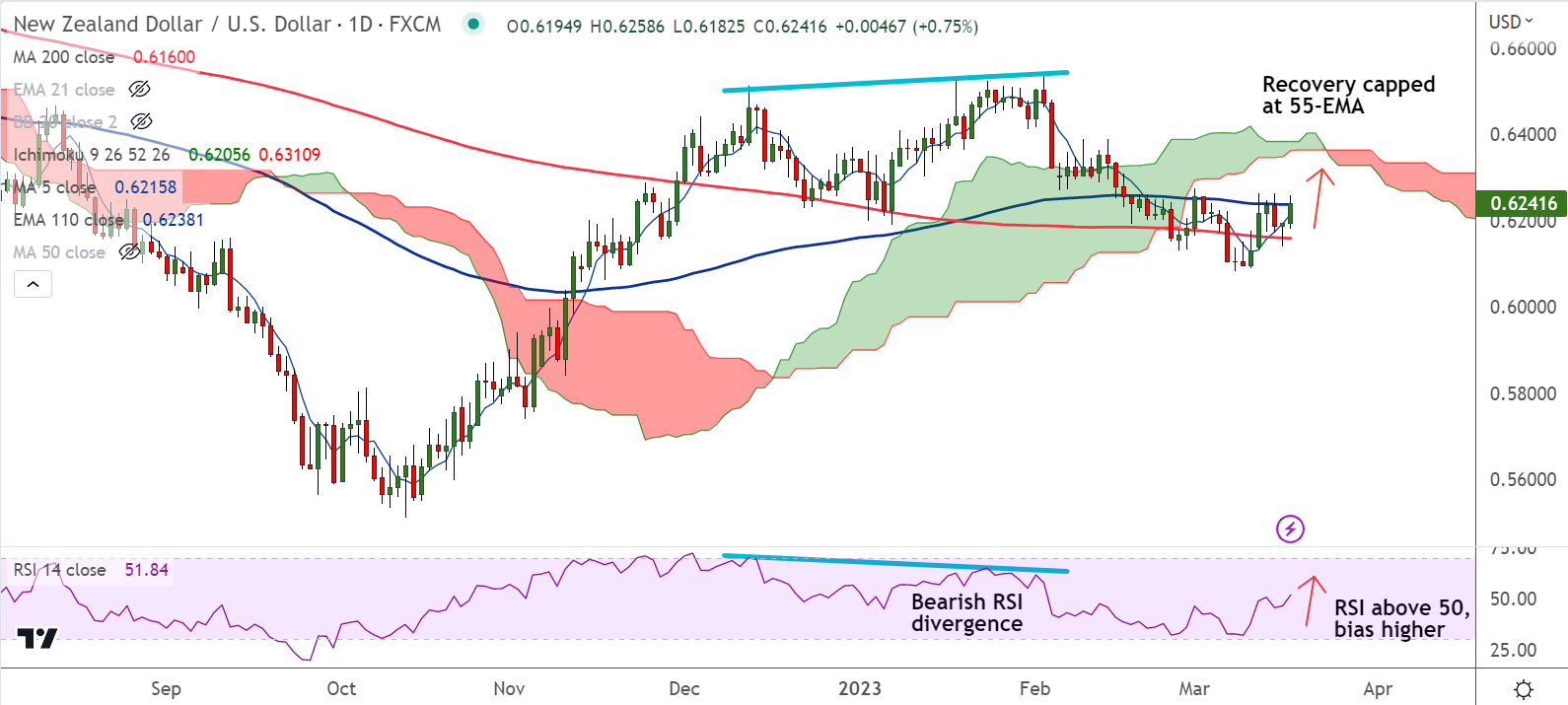

Chart - Courtesy Trading View

Technical Analysis:

- NZD/USD was trading 0.78% higher on the day at 0.6243 at around 11:25 GMT.

- The pair has bounced off 200-DMA with a Hammer formation on Thursday's candle

- MACD and ADX support upside in the pair, Chikou span is biased higher

- Momentum is bullish, Stochs and RSI are biased higher, RSI well above 50

- GMMA indicator shows major trend is neutral, while minor trend is turning bullish

Support levels:

S1: 0.6212 (21-EMA)

S2: 0.6160 (200-DMA)

Resistance levels:

R1: 0.6251 (55-EMA)

R2: 0.6286 (Upper BB)

Summary: NZD/USD bounce off 200-DMA has raised scope for further gains. Watch out for break above 55-EMA for further gains.