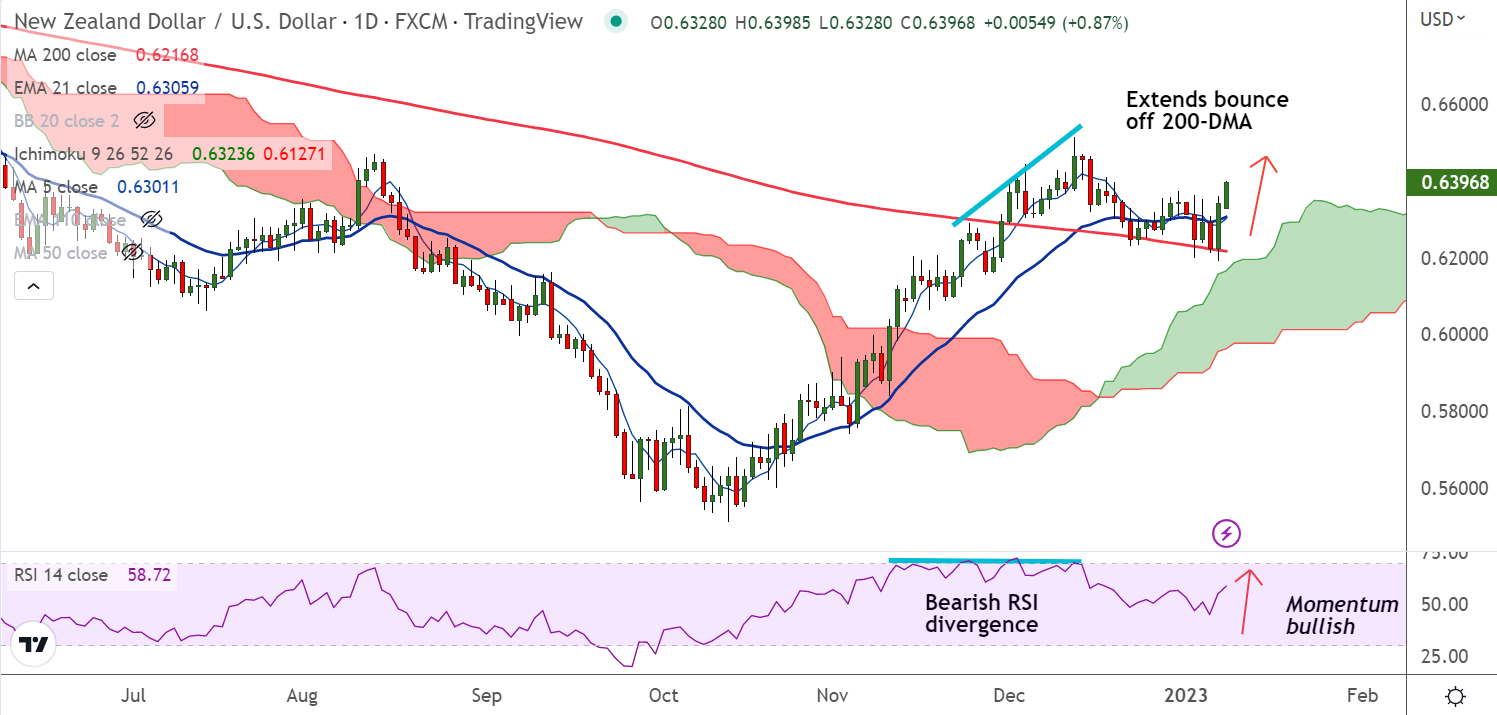

Chart - Courtesy Trading View

NZD/USD was trading 0.84% higher on the day at 0.6395 at around 05:40 GMT.

The pair is extending bounce off 200-DMA, refreshes 3-week high, outlook bullish.

China's reopening optimism combined with Fed pivot hopes boost risk sentiment, pushing the pair higher.

Market risk profile boosted as China reopens national borders after a three-year pause. While Friday's mixed data dragged the U.S. dollar down across the board.

Focus now on the U.S. consumer price index (CPI) data on Thursday, which is forecast to show annual inflation slowing to a 15-month low of 6.5% and the core rate dipping to 5.7%.

Markets have scaled back bets on Fed rate hikes after solid U.S. payroll gains and slower wage growth, along with a sharp fall in service-sector activity.

Fed fund futures now imply around a 25% chance of a 50 basis point hike in February, down from around 50% a month ago.

Fed Chair Jerome Powell's speech at a central bank conference in Stockholm on Tuesday will also be watched for clues.

Technical Analysis:

- NZD/USD extends gains for the second straight session

- The pair is extending bounce off 200-DMA support

- Momentum is bullish, Stochs and RSI are biased higher

- Price action is above cloud and Chikou span is biased higher

- MACD on verge of bullish crossover on signal line

Major Support Levels:

S1: 0.6306 (21-EMA)

S2: 0.6216 (200-DMA)

Major Resistance Levels:

R1: 0.6452 (Upper BB)

R2: 0.6513 (Dec 13th high)

Summary: NZD/USD was trading with a bullish bias. Scope for test of fresh multi-week highs above 0.64 handle.