- NZD/USD extends gains after break above 5-DMA.

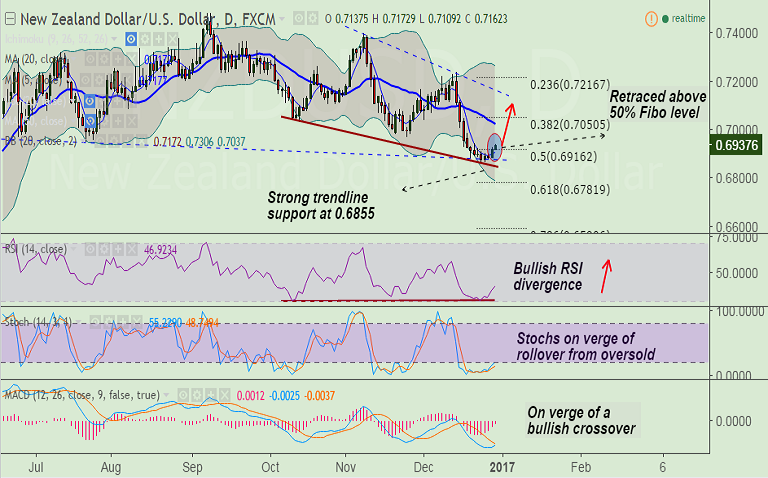

- The pair has retraced above 50% Fibo of 0.6347 to 0.7485 rally.

- Bullish RSI divergence on daily charts supports upside.

- Stochs are on verge of rollover from oversold which if done would provide further confirmation.

- Support levels - 0.6916 (50% Fib), 0.6904 (5-DMA), 0.6862 ( Dec 23 low), 0.6855 ( trendline support), 0.68

- Resistance levels - 0.6947 ( Dec -12 high), 0.70, 0.7027 (20-DMA), 0.7050 (38.2% Fib)

- Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-extends-recovery-from-multi-month-lows-break-of-5-DMA-seen-good-to-buy-dips-466713) is progressing well. TP1 almost hit.

Recommendation: Hold for further gains. Bullish invalidation on close below 5-DMA at 0.6904.

FxWirePro's Hourly NZD Spot Index was at 102.691 (Highly bullish), while Hourly USD Spot Index was at -100.214 (Highly bearish) at 0550 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.