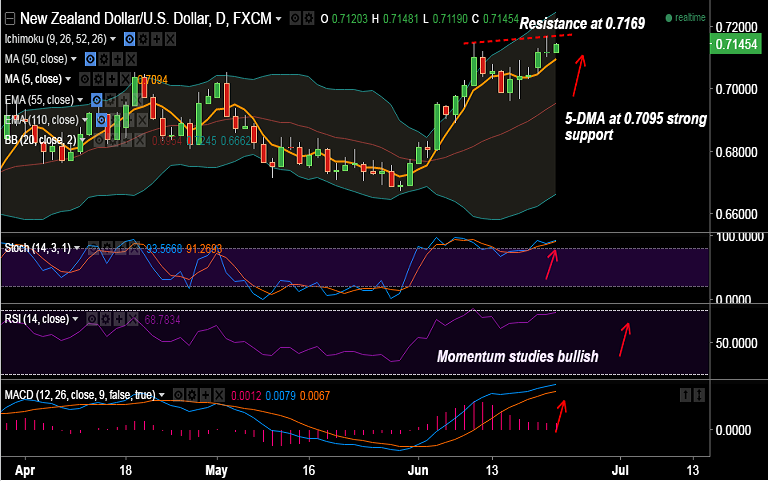

- NZD/USD unable to sustain at fresh yearly high at 0.7169 on Tuesday, slips lower, currently trading around 0.7145.

- Intraday bias for the pair remains higher, momentum studies are bullish.

- Stochastics are at overbought zone, but biased higher. RSI strength seen at 68 levels.

- 5-DMA at 0.7095 is strong support on the downside, weakness only on break below.

- Immediate resistance is seen at 0.7169, break above could see gains upto 0.72 and then 0.7245.

- Data released earlier today showed upbeat visitor arrivals, the migration data for May coming in at +5500 versus prior +5520.

- The Kiwi also boosted by rising oil prices, and weaker US dollar (Yellen's message to Senate Banking Panel overnight was one of caution).

Recommendation: Good to go long on breakout above 0.7169, SL: 0.7095, TP: 0.72/ 0.7245